However for Muslims living in western countries such opportunities are limited. Devon Bank has been offering Islamic Financing designed to avoid conventional interest common in traditional loans since 2003 for home purchases and refinancing from traditional loans.

Pdf Riba Free Loan In Islamic Finance Key To Social Development And Welfare

Pdf Riba Free Loan In Islamic Finance Key To Social Development And Welfare

We value your trust in Devon Bank and strive to provide you with the highest level of customer.

Halal business loans. Im an assistant to a broker to whom I will help to find and give details of fund seeking huge construction projects or any other huge fund requirements for halal business and he will find funders for that project. For instance a bank could purchase a house for money and after that re-pitch it to the borrower for a benefit through amortized. To make our community better-off.

Halal and haram are universal terms that apply to all facets of life. Our Islamic Financing Specialists will help you every step of the way and explain to you in detail how our product works. A Truly Interest Free Loan.

This credit sale is an acceptable form of Islamic finance and is not to be confused with an interest-bearing loan. Once the project has been funded the main broker will get. This price includes an agreed-upon profit amount.

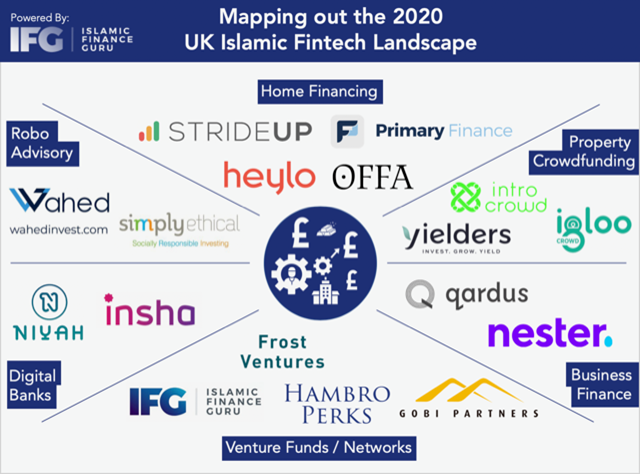

This article provides a list of Islamic. Islamic Finance Guru IFG is a hub that helps Muslims with their investment personal finance and entrepreneurial journeys. Halal Meat Seafood - Small Business Loan Success Story - YouTube.

As a result we have been providing life-changing support by means of granting interest-free loans since 1994 as one of. Sharia Banking has been experiencing extraordinary developments in several islamic countries and Europe. We do this for one reason.

This was the name given to the helpers of Prophet Muhammad Peace and Blessings of Allah be upon him in Madinah. Some of these entrepreneurs are using or looking for Halal business loans to kick start their entrepreneurial journey. Halal Meat Seafood - Small Business Loan Success Story.

All over Europe Islamic banks are establishing branches western banks are offering Sharia-compliant. The opposite of halal is haram which means unlawful or prohibited. We want to take Muslims from being among the poorest in society to those who are wisest with their money.

But if youre looking for a couple of quick fixes these low capital intensive business ideas will get you going in 2017. Mohammad Kaskas has gotten traditional bank loans and also got funding from Bank of Whittier three years ago for his Fresh Choice Marketplace an ethnic. Al Rayan Bank is one such place which provides Halal business loans in the UK.

Usually funding will be from a western country obviously funding will be based on interest and equity in the projects. Halal is an Arabic word which means lawful or permitted. About Islamic Finance Guru.

Halal Bed Breakfast. Halal business ideas are important in creating a viable entity hence why 75 have been listed in this article. The intermediary investor then agrees on a sale price with the prospective buyer.

A home loan made by the sharia or Islamic law which precludes the instalment or receipt of intrigue. Muslim business attire can vary from formal to non formal. Because halal simply means permissible in the Arabic language it can be alluded to any product or service which does not violate Islamic laws and social norms in any way.

Ideal for someone who has a home and spare rooms in a city or country that attracts tourists an Islamic Bed and Breakfast will attract the niche Muslim traveler. An Islamic home loan might be an intrigue free credit however frequently it is a more unpredictable exchange. We aspire to take lessons from the Ansar and bring them to life in the 21st Century.

0 Down Sharia Compliant Medical Practice Financing Medical and other Professionals can now access 0 Down Sharia Compliant Practice Financing and as little as. Ansar literal meaning helpers in the Arabic language. The purchase may be made outright lump sum or through a series of deferred installment payments.

This will not cost you much and it can be done from the comfort of your own home. In some countries this sharia compliant banking system has been enjoying an average growth-rate of 402 percent per year from 2007 to 2015. Some of these services may include basic personal loans business loans loan consolidation opportunities and more.

MECHANISM OF A SHARIAH COMPLIANT HALAL MORTGAGE. Hi Sir Scenario 1. Halal Investment HFA started business in 1989 as a registered cooperative in the inner Melbourne suburb of Burwood with 20000 and a vision to address the financial banking and investment needs of the Invest in Peace.

For people living in Muslim nations there are more opportunities to get such financing as there are more banks that offer riba-free loans to their customers.

Islamic Fintechs Are On The Rise But Will They Survive Sifted

Islamic Fintechs Are On The Rise But Will They Survive Sifted

The Islamic Banking System Not Conductive To The Start Up Of Grin

The Islamic Banking System Not Conductive To The Start Up Of Grin

Islamic Organisation In India Offers Interest Free Loans To People Of All Faiths Ilmfeed

Islamic Organisation In India Offers Interest Free Loans To People Of All Faiths Ilmfeed

Understanding Islamic Banking And Its Prospect In The Uk Grin

Understanding Islamic Banking And Its Prospect In The Uk Grin

![]() Shariah Compliant Loans Its Introduction And Types Aims Uk

Shariah Compliant Loans Its Introduction And Types Aims Uk

Halal Small Business Ideas For 2021 Business In America

Halal Small Business Ideas For 2021 Business In America

Business Question Is The Government Business Bounce Bank Loan Halal Or Haram Business And Career Questions Ifg Islamic Finance Forum

Business Question Is The Government Business Bounce Bank Loan Halal Or Haram Business And Career Questions Ifg Islamic Finance Forum

Islamic Finance Sharia Compliant Loans Sme Loans

Islamic Finance Sharia Compliant Loans Sme Loans

Islamic Finance Sharia Compliant Loans Sme Loans

Islamic Finance Sharia Compliant Loans Sme Loans

Ethical Finance For Islamic Businesses Businessfirst

Ethical Finance For Islamic Businesses Businessfirst

Why Pay More For Home Financing Uif Corporation

Why Pay More For Home Financing Uif Corporation

/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)

Comments

Post a Comment