To qualify for this exclusion your adjusted gross income AGI must be less than. How Taxes on Unemployment Benefits Work.

This form helps structure the calculation of how much should be reported given the various figures employers must consider.

How do unemployment taxes work. At the federal level employers also must pay an unemployment tax called the Federal Unemployment Tax Act FUTA. However the American Rescue Plan Act of 2021 allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020. With wages you are expected to pay taxes on your income as you earn it.

Unemployment taxes are paid by employers to the federal government and states in order to fund unemployment benefits for out-of-work employees. If you received unemployment benefits last year and you paid taxes on those benefits you might qualify for a tax. Employers must pay federal unemployment taxes and file an annual report.

The IRS will receive a copy as well. Unemployment taxes are paid by employers and these taxes go into a state fund to aid workers who have lost their jobs. Unemployment compensation is taxable.

Most employers pay both federal and state unemployment taxes. You pay FUTA tax only from your own funds. STATEN ISLAND NY.

Unemployment benefits are generally taxable. A portion of the funds cover. The rate charged its called a tax is based on the type of business.

Employees do not pay this tax or have it withheld from their pay. What are Unemployment Taxes. You dont deduct unemployment taxes from employee wages.

This tax is based on several factors including the number of employees and the number of claims that former employees of the firm have filed for past layoffs. The federal unemployment taxesare used to cover the costs of administering state unemployment insurance programs as well as to fund state job-search programs. 7 Withholding Taxes From Unemployment Compensation The IRS views unemployment compensation as income and it generally taxes it accordingly.

Unemployment benefits are income just like money you would have earned in a paycheck. Department of Labor monitors the system. Employers pay into the system based on a percentage of total employee wages.

In brief the unemployment tax system works as follows. Other than Arkansas New Jersey and Pennsylvania employers pay into the unemployment benefits system by paying a tax. Individual states accounts for covering normal.

At the federal level unemployment benefits are counted as part of your income along with your wages salaries bonuses etc. Anyone who received unemployment benefits in 2020 can claim up to 10200 tax-free according to a provision in the 19 trillion coronavirus relief bill. Unemployment Taxes at the Federal Level.

And taxed according to your federal income tax bracket. Employers report their FUTA tax by filing an annual Form 940 with the Internal Revenue Service. The unemployment program for employers works like insurance meaning that employers pay for the coverage.

You might get a 10200 tax break from the IRS. Federal Unemployment FUTA Tax. Employers report and pay FUTA tax separately from Federal Income tax and social security and Medicare taxes.

In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse. The official measure of unemployment in the US is currently the U-3 measure which defines the unemployed as those who do not have a job those who have actively searched for work in the prior. How do Unemployment Taxes work.

Youll receive a Form 1099-G after the end of the year reporting in Box 1 how much in the way of benefits you received. With most income like wages taxes are pay-as-you-go. If you are receiving unemployment benefits check with your state about voluntary withholding to help.

Unemployment insurance is financed by taxes paid by employers and remitted to the federal trust fund where its divided into three buckets. Unemployment benefits are usually taxable as income and are still subject to federal income taxes above the exclusion or if you earned more than 150000 in 2020. The unemployment rate is a closely followed indicator used by businesses investors and private citizens to gauge the health of the US.

These taxes are paid at both the state and federal level. Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes.

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

The Effects Of Employer Payroll Tax Cuts Vox Cepr Policy Portal

How Do Unemployment Taxes Work Fox Business

How Do Unemployment Taxes Work Fox Business

/GettyImages-182396779-56a0a54a3df78cafdaa38ff0.jpg) Important Unemployment Tax Questions For Employers

Important Unemployment Tax Questions For Employers

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

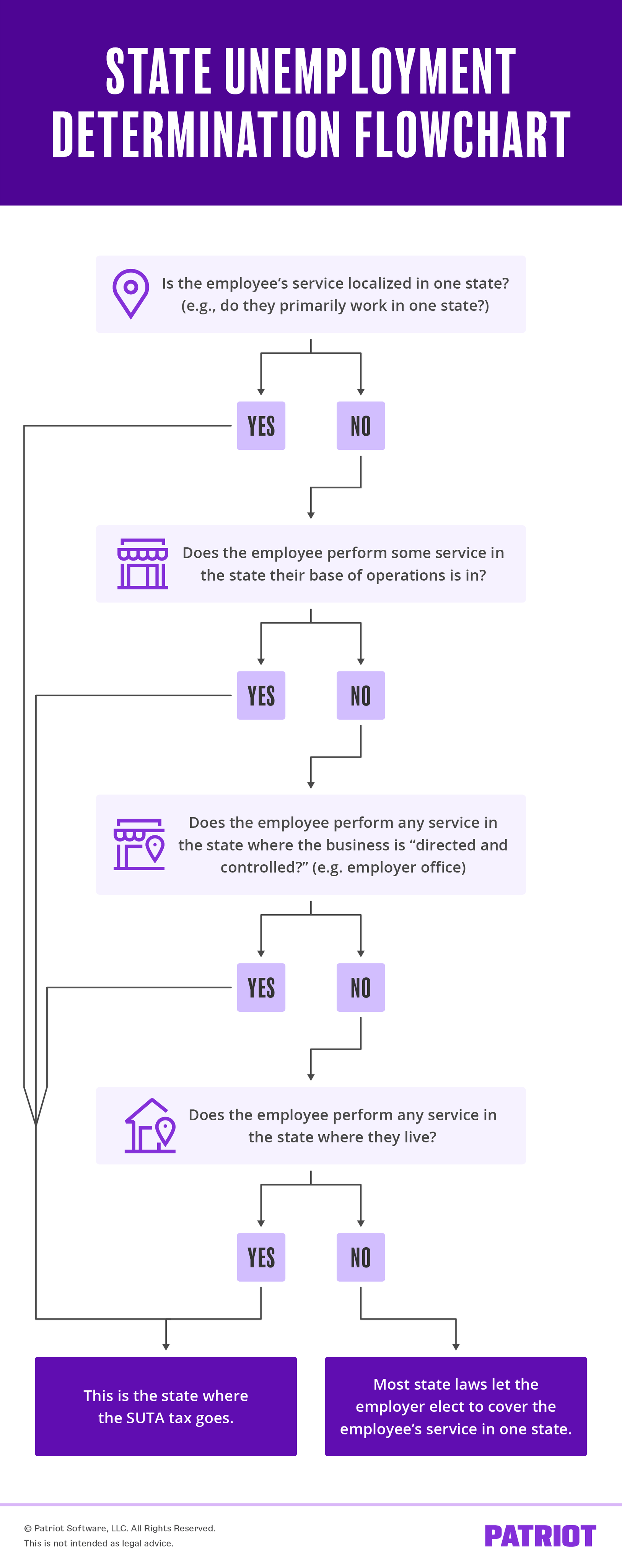

Unemployment Tax Rules For Multi State Employees Suta Tax

Unemployment Tax Rules For Multi State Employees Suta Tax

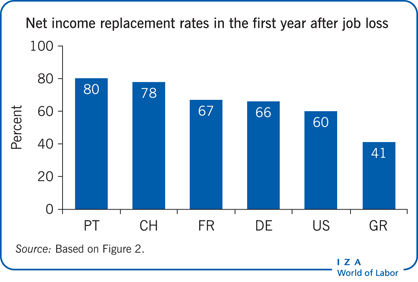

Iza World Of Labor Unemployment Benefits And Unemployment

Iza World Of Labor Unemployment Benefits And Unemployment

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

How Does Unemployment Work For Employers Handling Claims

How Does Unemployment Work For Employers Handling Claims

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Comments

Post a Comment