October 15 is the filing deadline for those who requested an extension Taxpayers who requested an automatic filing extension should complete their 2019 tax returns and file on or before the Oct. The extension of the federal income tax filing and payment deadline to May 17 is completely automatic.

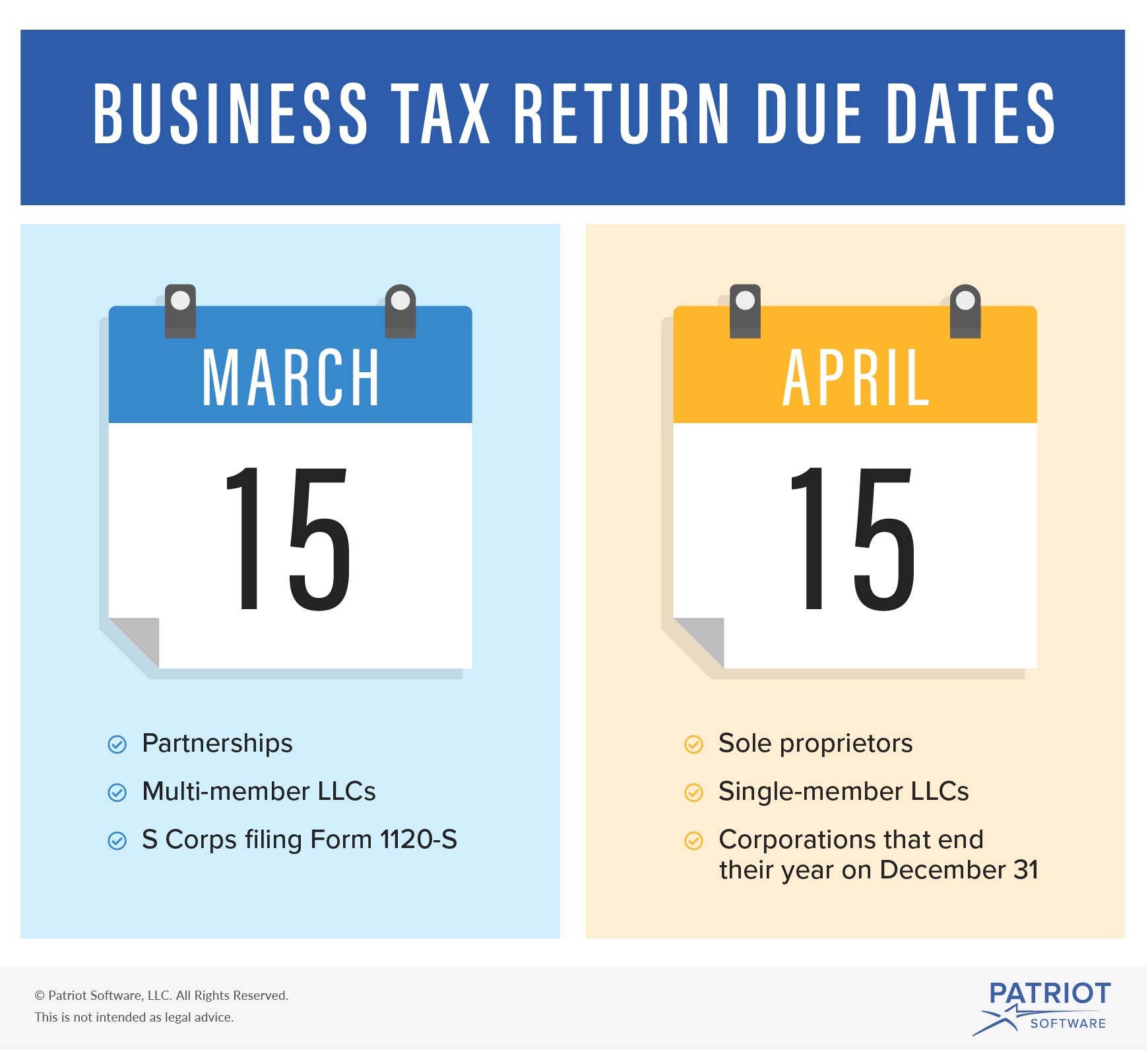

How To File For A Business Tax Extension Federal Bench Accounting

How To File For A Business Tax Extension Federal Bench Accounting

Penalties and interest will not be charged if payments are made by the extended deadline of September 30 2020.

2019 tax return extension deadline. You will have to print out your tax forms and mail them into the IRS because the IRS will not accept e-filed tax returns after the extension deadline October 15th for most years. File Your 2019 Return by October 15 to Avoid Penalties If you chose to extend your tax returns due date the tax extension deadline is October 15. The deadline to file 2019 individual tax returns ie for individual income taxes and the commercial profits of natural persons is extended until 31 March 2021.

As far as individuals are concerned the deadline for filing the 2019 income tax and MBT returns is extended to 31 March 2021. Income Tax Return Due Date Extended for FY 2019-20 AY 2020-21 again by issuing CBDT issues Circular No. Convenient electronic filing options including IRS Free File are still available.

15 2021 to file their returns and make tax payments. The federal tax extension also applies to any first quarter estimated tax payments that are due by April 15th. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension.

Suspended Payments Must Be Restarted. Electronic submission of the 2019 corporate income tax return TD4 Electronic submission of the 2019 personal income tax return TD1A of. You can use FreeTaxUSA to file taxes from 2019 all the way back to 2013.

Q1 2020 Estimated Tax Payment Deadline Extended. As a solution the draft bill provides for a six-month extension of the 2019 tax periodwhich normally ends at the end of February 2021unless the tax return was requested beforehand by the competent tax office in the taxpayers specific case. 2019 company tax returns The 2019 income tax return filing deadline was further extended to 31 March 2021 when the island entered its second period of lockdown on 23 January 2021.

To get the extension you must estimate your tax liability on this form and should also pay any amount due. 082021 dated 30042021 under section 119 of the IT Act 1961. 19 2020 the IRS announced tax deadline extensions for individuals and businesses impacted by the California wildfires and Hurricane Delta.

The move is in recognition of the impact and disruption the COVID-19 pandemic will have caused for many Islanders and businesses. No mention has been made about second-quarter estimated tax payments. Get an extension when you make a payment.

For both individuals and corporate taxpayers the deadline for filing the income tax CIT MBT and NWT returns is extended from 31 March 2021 to 30 June 2021. 15 now have until Jan. The extension of deadlines for filing the 2019 and 2020 tax returns will be part of a draft law to.

E-file Your Extension Form for Free. Those affected by the California wildfires and who had a valid extension to file their 2019 tax returns by Oct. If you filed an extension application for your 2019 taxes you have until October 15 2020 to file.

This extension is for six months and applies only to filing. Is It Too Late to File Past Year Taxes. It is not too late to file back taxes.

Filing this form gives you until Oct. Tax Extension Deadline. In accordance with a Decree issued on 12 March 2021 the following deadlines are extended to 30 September 2021.

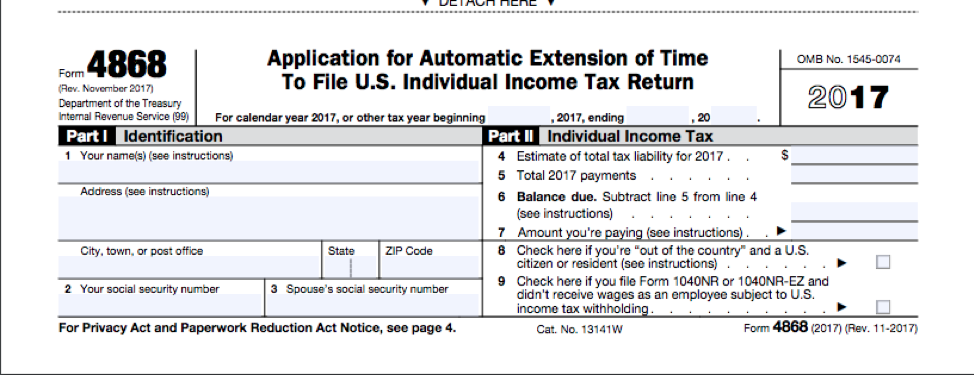

September 15 for the third quarter and January 15 2021 for the fourth quarter. But if you need more time you will need to file for an extension with Form 4868. 15 to file a return.

If you must make estimated payments on 2020 taxes the quarterly deadlines are the same. Payment Deadline Extension The CRA has extended the payment due date for current year individual corporate and trust income tax returns including instalment payments from September 1 2020 to September 30 2020. 2019 income tax returns deadline extended until 28th February 2021 Thursday 24 September 2020 The Revenue Service is extending the deadline for 2019 income tax returns from 30 November 2020 to 28 February 2021.

Use our prior year software to file whichever year you missed. It has extended due dates of filings income tax returns belated as well as revised TDS payment and return due dates under certain sections Income-tax return in response to section 148 Appeals DRC applications etc.

Extension Of Income Tax Return Due Date For Ay 2019 20

Extension Of Income Tax Return Due Date For Ay 2019 20

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

New Deadlines For Filing Tax Returns As Required By Section 1308 Chapter 13 Trustee Edky Trustee S Blog

New Deadlines For Filing Tax Returns As Required By Section 1308 Chapter 13 Trustee Edky Trustee S Blog

October 15 Is The Deadline For Filing Your 2019 Tax Return On Extension

October 15 Is The Deadline For Filing Your 2019 Tax Return On Extension

October Tax Deadline Nears For Extension Filers H R Block Newsroom

October Tax Deadline Nears For Extension Filers H R Block Newsroom

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Important Q1 2019 Tax Deadlines Pugh Cpas

Important Q1 2019 Tax Deadlines Pugh Cpas

How To File A 2019 Tax Return Extension By July 15

How To File A 2019 Tax Return Extension By July 15

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Tax Extension Form 4868 E File By May 17 2021

Tax Extension Form 4868 E File By May 17 2021

Business Tax Return Due Date By Company Structure

Business Tax Return Due Date By Company Structure

Https Assets Kpmg Content Dam Kpmg Qa Pdf 2020 3 Extension Of Deadline For Filing Tax Returns For The Year Ended 31 December 2019 Pdf Pdf

:max_bytes(150000):strip_icc()/Screenshot43-d22959eda68841df96f3e8f1bb223a34.png)

:max_bytes(150000):strip_icc()/Screenshot64-177a60f2f4d6482eb80dfbc1be971169.png)

Comments

Post a Comment