Its the most important factor that affects your credit score. No credit isnt the same thing as good credit in fact its the opposite.

How Your Credit Score Is Calculated Wells Fargo

How Your Credit Score Is Calculated Wells Fargo

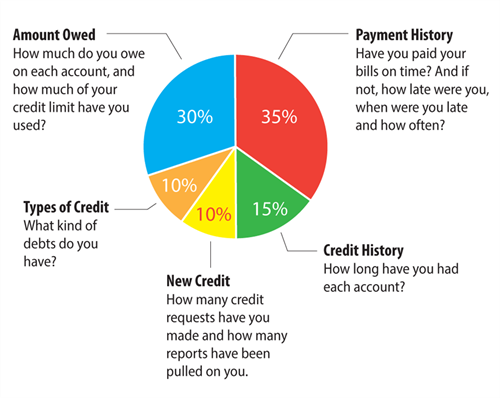

However if you do something like apply for a bunch of loans or credit cards within a short span of time it can lower your score but not as much as other actions.

What hurts your credit score. Theres also not much you can do about the length of credit history. Having no or little credit means that nothing gets reported to create your credit score. Since a higher credit score generally means you can get lower interest rates on loans it is in your best interest to do things that help your score and avoid those things that hurt it.

Checking your credit report hurts your score About 1 in 5 credit card users mistakenly believes checking their credit report could cause their score to drop according to a 2018 survey from Discover. What Hurts Your Credit Score. The main credit scoring models are FICO and VantageScore.

Maxing out a credit card. 15 Things That Hurt Your Credit Score Paying Late. It depends on the financial institution.

How much your score drops due to a settlement depends on other information in your credit profile but settling for less than the full amount will almost always have a significant negative impact on your score. What Can Hurt Your Credit Scores. Not Paying at All.

Now that you know how low your credit score can fall lets focus on what can cause it to tumble. Credit card companies auto dealers and mortgage bankers are three types of lenders that will check your credit score before deciding how much they. The best thing you can do to make sure your credit score isnt affected is to pay your bills on time.

Consistently being late on your credit. Late payments are what hurts your credit score the most. The other factors like length of credit history new credit and mix of current debt can also affect your score even if its not as much as your payment history and credit utilization.

It therefore follows that a bad or poor payment history will. Although a settled account on your credit report is generally better than a charged off account or a bankruptcy it still hurts your credit score to have anything other than a paid-in-full record. FICO credit scores which are used by 90 percent of.

Disproportionately or exclusively using one type of credit is detrimental to your credit score. What hurts your credit score the most. You Lost Your Job.

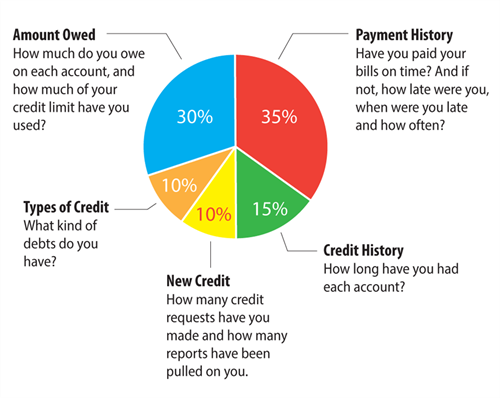

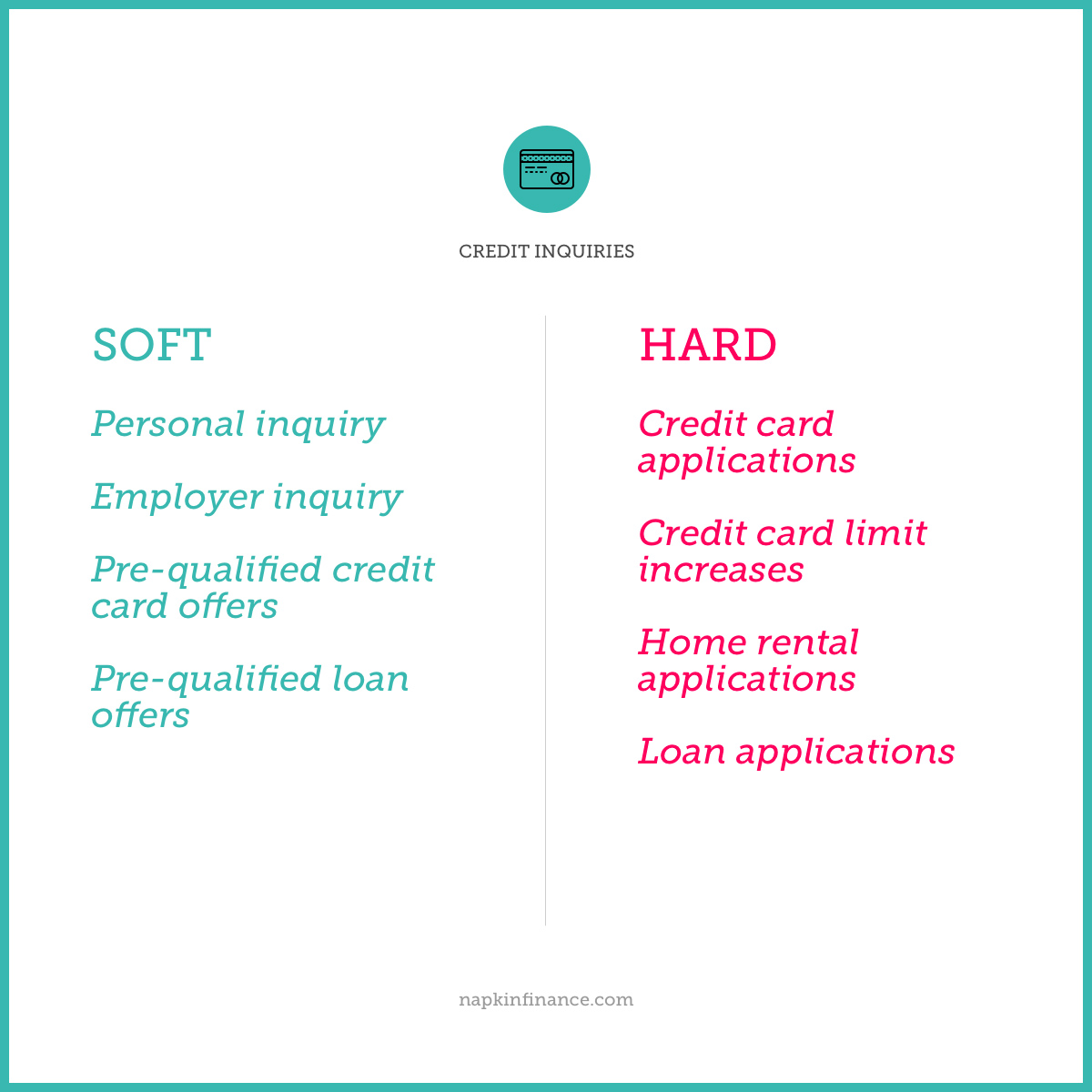

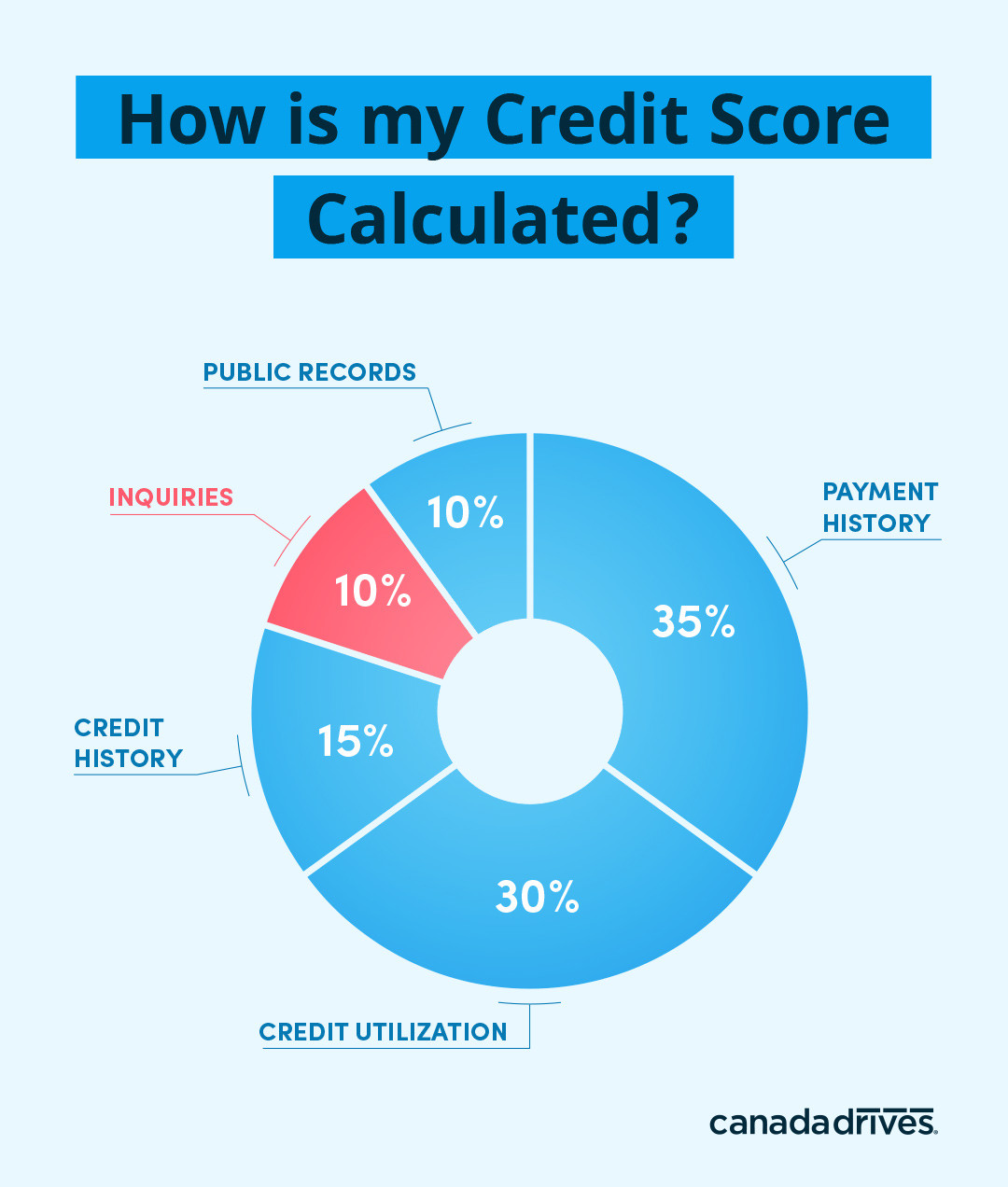

Did you know payment history makes up 35 percent of your credit score. Your credit score ranges from 300-850 on the FICO scale created by the Fair Isaac Corporation. This is just one of the many complex rules baked into FICOs traditional method for calculating your credit score.

This is the most obvious example of what can hurt your credit score but its worth mentioning. For instance missing a credit card payment is bad and keeping your card balances low relative to your. If your balances increase because youre still racking up interest you risk increasing your credit utilization ratio and that could hurt your score.

Having an Account. Missing a card or loan payment. Your payment history is basically the record of whether youve paid your bills on timeor not.

A soft check has no impact on your credit score. Not Having Enough Credit. According to FICO a.

Your payment history makes up 35 of your FICO Score-- the most heavily weighted category -- so it. Knowing what hurts your credit score can help you raise it and reach your financial goals. Payment history has a pretty big effect on your credit score.

Bill payment history simply means how often you pay your bills on time. Both FICO and VantageScore consider credit mix as its known when calculating your score. Lenders want to know youre reliable and youll pay every month by the deadline.

Thirty-five percent of your credit score is your payment history. Sometimes when you request a line of credit online a financial institution will use a soft credit check. When someone pulls your credit report it dings your credit score unless that someone is you or a lender evaluating your credit for promotional purposes.

Each month you miss a. If you end up applying for loans lines of credit and credit cards frequently when you dont need them you may be doing harm to your credit. Payment history accounts for 35 percent of your FICO score.

Read below to discover five factors you may not be aware of that can affect your credit score. Completely ignoring your credit cards bills is much worse than paying late. Credit utilization accounts for 30 percent of your FICO score.

It accounts for about 35 of your credit score for each of the scoring models. The following common actions can hurt your credit score. The lower your balances are.

They make up to about 35 of your credit score and they stay on your record for up to 7 years. As we discussed above certain core features of your credit file have a great impact on your credit score either positively or negatively. The formula can be a bit confusing to consumers outside of the more obvious maxims.

Late payments a high amount of.

What Hurts Your Credit Score Visual Ly

What Hurts Your Credit Score Visual Ly

9 Ways Your Credit Score Affects Your Everyday Life Student Loan Hero

9 Ways Your Credit Score Affects Your Everyday Life Student Loan Hero

Understanding Optimizing Your Credit Score Sirva Home Benefits

Understanding Optimizing Your Credit Score Sirva Home Benefits

How Paying Off Student Loan Debt Affects Your Credit Score

How Paying Off Student Loan Debt Affects Your Credit Score

17 Things That Hurt Your Credit Score Creditcards Com

17 Things That Hurt Your Credit Score Creditcards Com

Lesson 5 What Helps And Hurts Credit Napkin Finance

Lesson 5 What Helps And Hurts Credit Napkin Finance

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

What Hurts And Affects Your Credit Score 9 Factors Errors To Fix

What Hurts And Affects Your Credit Score 9 Factors Errors To Fix

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score Tips For Fico Repair

Ouch Here S What Hurts Your Credit Score Infographic Cash 1 Blog News

Ouch Here S What Hurts Your Credit Score Infographic Cash 1 Blog News

Do Credit Checks Hurt Your Credit Score

Do Credit Checks Hurt Your Credit Score

6 Surprising Things That Won T Hurt Your Credit Score Creditcards Com

6 Surprising Things That Won T Hurt Your Credit Score Creditcards Com

Improve Your Credit Score In 6 Months Blog Details Essex Bank

Improve Your Credit Score In 6 Months Blog Details Essex Bank

8 Biggest Factors That Impact Your Credit Score

8 Biggest Factors That Impact Your Credit Score

Comments

Post a Comment