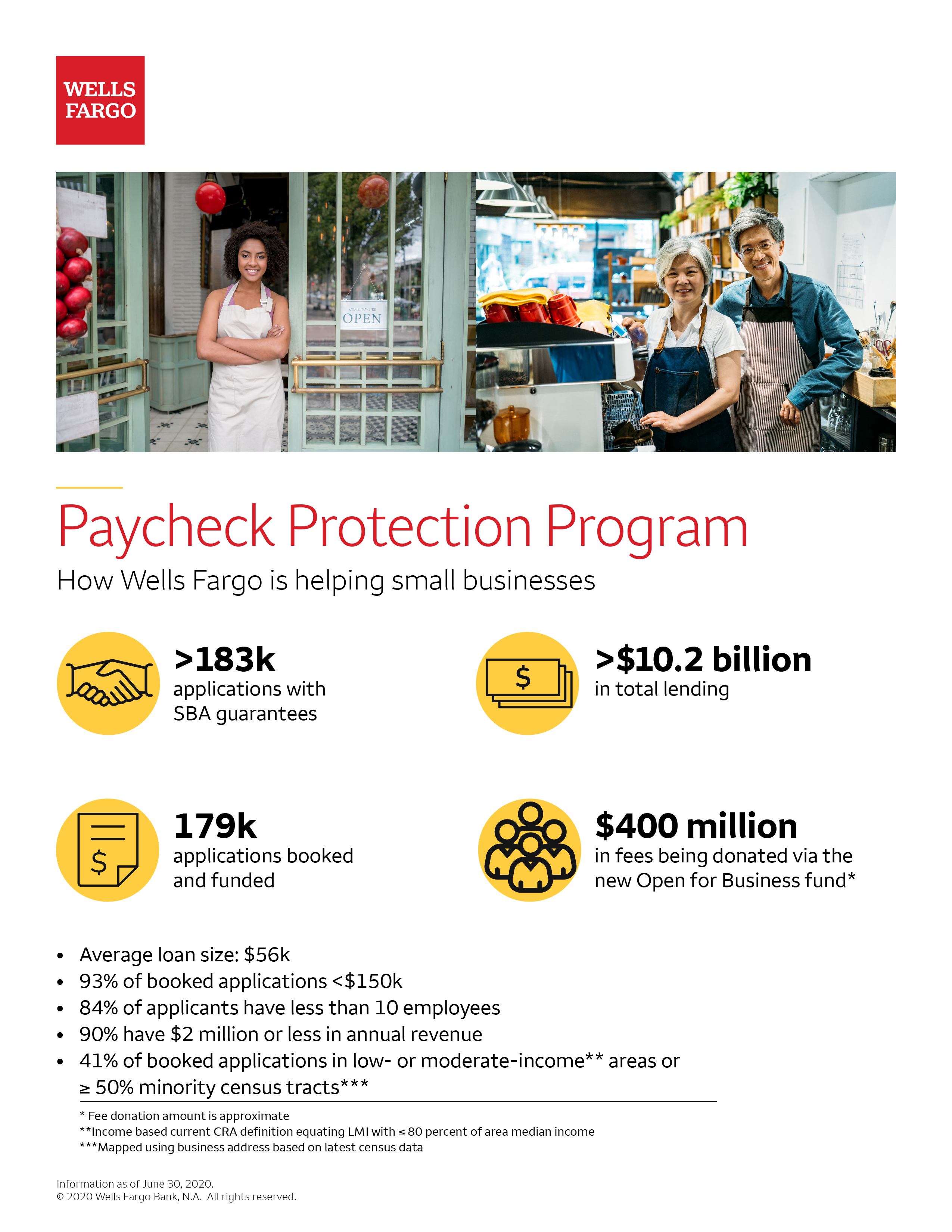

Wells Fargo has something for all small business including business credit cards loans and lines of credit. Letters obtained from Wells Fargo.

Business Loan Applications Wells Fargo

Business Loan Applications Wells Fargo

Your credit history shows you how you managed your loan over time.

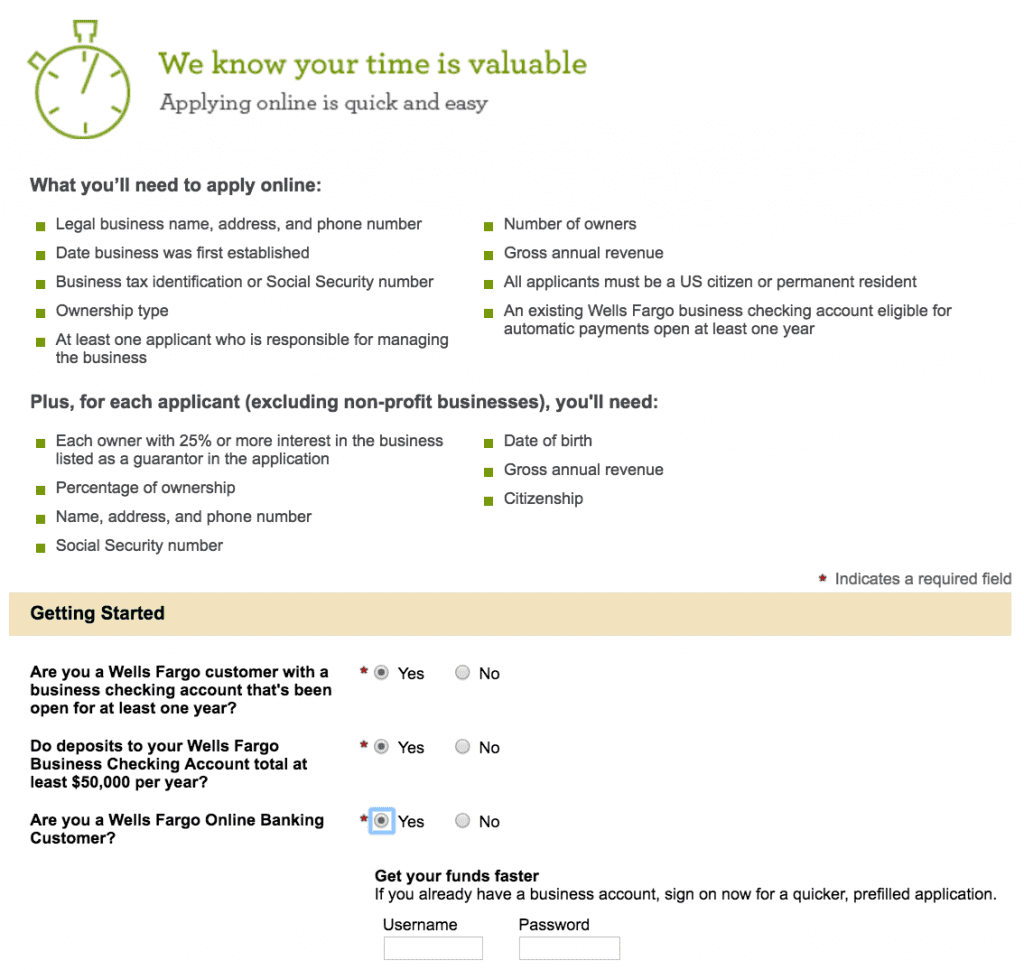

How to get a business loan from wells fargo. Visit Wells Fargo online or visit a store to get started. Customers with a Wells Fargo business checking account will see a link to apply within their Wells Fargo Business Online or Commercial Electronic Office CEO. It contains your opened or closed credit Wells Fargo account and your past 7-10 years of payment history.

Apply today its fast and easy. 1 PPP loan applicants must have an eligible Wells Fargo business checking account that corresponds to. Keep in mind however that theres a surprising amount of customer complaints and negative press against Wells Fargo.

Wells Fargo is one of the few large banking institutions that still works with small businesses after the 2008 economic crash. The Process of Applying for a Personal Loan from Wells Fargo. And with its monthly payment schedule and terms from one to five years a BusinessLoan provides a versatile way to fund expenses associated with expansion and growth.

Businesses with an existing Wells Fargo account that has been open for at least one year will be considered for a FastFlex loan which can be funded as soon as the next business day. If youre interested in a small business loan from this lender heres what you need to know. These loans can range from one- to six-year terms and Wells Fargo offers both secured and unsecured options.

Got an email inviting me to log into my WF account and. Emergency repairs one-off expenses expansions and remodels are all legitimate uses for a business loan with Wells Fargo. FastFlex will be added to Wells Fargos existing suite of small business lending products which already includes business lines of credit and longer term loans.

How difficult is it to get a Personal loan with Wells Fargo. Wells Fargo doesnt list any specific hard requirements. But generally you must meet the following criteria to get a loan from this bank.

If you already have an account with Wells Fargo you likely need to be in good standing to qualify for credit. Buyers must submit a prequalification letter from Wells Fargo or any other lender. Choosing Wells Fargo loans can receive from 3000 up to 100000 depending on your needs.

Just woke up with a notification my PPP Loan through Wells Fargo was deposited. Multiple purchases of vehicles or equipment are permitted with a single loan. When partnering with Wells Fargo you can seek an SBA 504 loan amount of up to 65 million.

One-year term with fixed weekly payments required from a Wells Fargo business account. The Equipment Express Loan includes 100-percent vehicle and equipment financing. The bank offers secured and unsecured lines of credit secured and unsecured term loans SBA loans commercial real estate loans and healthcare practice loans.

Filled out the interest form within about an hour of it going live. Over 18 years old. Got an email saying they couldnt offer me a loan at that time but put me in a queue I think most people got this one.

Wells Fargo Bank personal loans are a line of credits that attracts the attention of those clients who have unpredictable expenses and do not have enough money to cover them. Wells Fargo Business Loan You can get Wells Fargos basic term loan the aptly named Wells Fargo BusinessLoan in amounts from 10000 to 100000. Anonymous asked in Business Finance Personal Finance 1 decade ago.

And fixed rates starting at 1399. Loan amounts between 10000 and 35000. US citizen or permanent resident.

When requesting a fresh loan account based on main variables frequently recognized as 5 Cs of credit the lenders will assess your request. Find the right financing for you. Heres a timeline of my process.

If you are not currently a Wells Fargo customer then you are required to come to a branch in order to fill out an application. As well Wells Fargo Business Loans require a 150 opening fee which can be waived as a benefit of a Wells Fargo Business Choice Checking or Platinum Business Checking Account according to information on the Wells Fargo website. Credit score of 670 or higher.

You may be able to borrow up to 899 of your homes value and. FastFlex Small Business Loan. Im interested in applying for a small personal loan with wells fargo 4000 and Im going to have a co-applicant since my credit isnt wonderful the reason i get denied places it says is because of lack of.

Wells Fargo offers mortgages and home equity lines of credit to its borrowers. How to get a pesonal loan. If you are an existing customer then you may be able to apply for a personal loan.

Wells Fargo the nations third-largest bank is a logical place to shop if youre looking for a small business loan.

Wells Fargo Business Loans Review April 2021 Finder Com

Wells Fargo Business Loans Review April 2021 Finder Com

Wells Fargo Wells Fargo Small Business Loans Review 2021

Wells Fargo Wells Fargo Small Business Loans Review 2021

Wells Fargo Business Loan Application Pdf Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Business Loan Application Pdf Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Business Loans Review 2021 Merchant Maverick

Wells Fargo Business Loans Review 2021 Merchant Maverick

Financing For Small Business Wells Fargo

Financing For Small Business Wells Fargo

How Small Business Loans Work List Of Providers Digital Com

How Small Business Loans Work List Of Providers Digital Com

Sba Term Loans Wells Fargo Small Business

Sba Term Loans Wells Fargo Small Business

Wells Fargo Launches 400 Million Small Business Recovery Effort Business Wire

Wells Fargo Launches 400 Million Small Business Recovery Effort Business Wire

![]() Small Business Loans And Lines Of Credit Wells Fargo

Small Business Loans And Lines Of Credit Wells Fargo

Wells Fargo En Twitter Hi Sarah Given The Exceptionally High Volume Of Requests We Have Already Received We Are No Longer Accepting Requests For Ppp Loans Please Visit The Sba Website For

Wells Fargo En Twitter Hi Sarah Given The Exceptionally High Volume Of Requests We Have Already Received We Are No Longer Accepting Requests For Ppp Loans Please Visit The Sba Website For

Small Business Loans Wells Fargo

Small Business Loans Wells Fargo

Wells Fargo Enters Small Business Lending With Fastflex Lend Academy

Wells Fargo Enters Small Business Lending With Fastflex Lend Academy

Comments

Post a Comment