Historically low tax rates make 2021 a great time to convert your traditional IRA to a Roth account. When you have a lower than average tax rate.

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

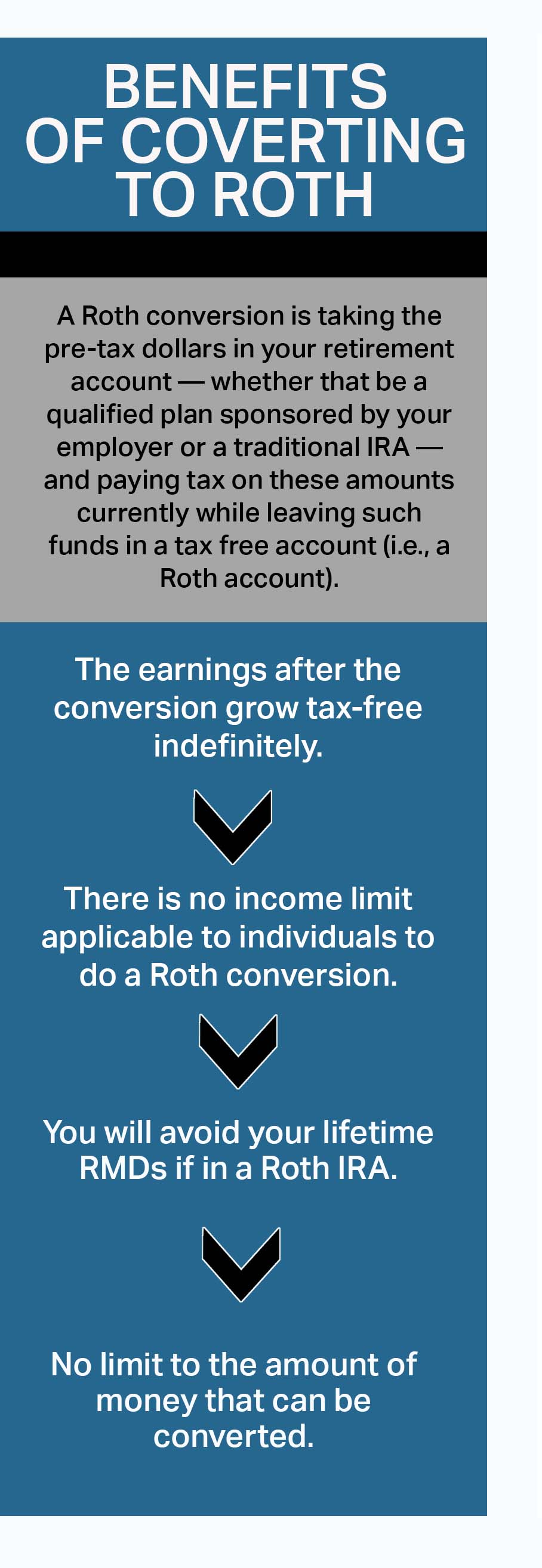

If you are over a certain age you must take your Required Minimum Distribution RMD before you can convert your Traditional IRA to a Roth IRA.

Best time to convert traditional ira to roth. Until recently if you converted an IRA to a Roth the law let you have a do-over. RMDs from a traditional IRA cannot be converted into a Roth IRA. Roth IRAs have the added benefit of not requiring minimum distributions which now begin at the age of 72 for traditional IRAs.

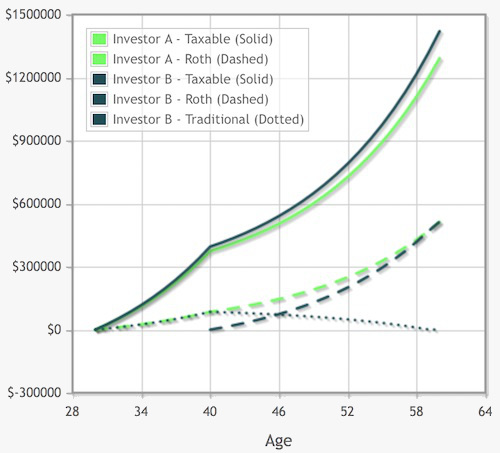

It rises only to about 5 by the time you are 80. For example you may want to carry out your conversion. Usually the first year RMD is roughly 37 of the IRA.

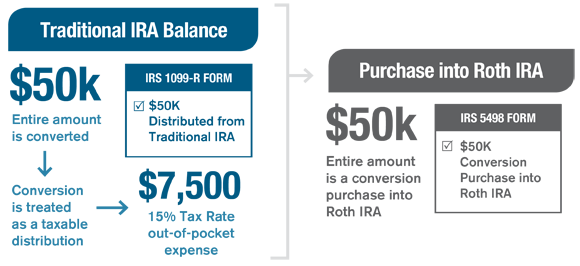

2020 May be the Best Year to Convert a Traditional IRA to a Roth IRA Thompson Greenspon CPA 2020 May be the Best Year to Convert a Traditional IRA to a Roth IRA July 1 2020 Erin Kidd EA Differences Between Traditional and Roth IRAs. In other words imagine that you had a traditional IRA that was worth 200000 on January 1. 2 Recognize That.

When youre in a lower tax bracket than usual you may be in a better position to convert assets to a Roth IRA. Many financial experts are touting this as a good time to convert it to a Roth since you can pay taxes on the lower account value and when the market. Its the best time in history to convert to a Roth says Elijah Kovar co.

So if we assume your 57000 is worth 65000 in two years 7-ish growth rate your RMD. Before 2018 taxpayers who converted an IRA to a Roth had until the. Low Tax Rates.

In order to be deemed as a qualified distribution a Roth IRA distribution must be made after a 5-taxable-year period of participation and occur on or after reaching age 59 ½. The value is now 5500. However you may want to talk with your financial advisor and determine the best timing.

The Roth IRA conversion works this way. However you usually have to reach age 59½ before you can do so. Ideally the best time to convert your traditional IRA to a Roth IRA is when you are in your lowest tax bracket and when the stock market is down.

The conversion process on our website includes a step to do this. Theres probably no good time to have a bigger tax bill but if there were this year would be that time. 12 Best Dating Websites for Seniors.

Low-income periods can be a good time to convert to a Roth IRA. Note that IRS rules allow you to take your total RMD from one or more IRA accounts including those not held at Betterment. Doing a Roth conversion when the market is down means that your account is worth less so your tax bill is smaller.

Converting certain IRA assets to Roth IRA assets can help boost after-tax retirement income and reduce future required minimum distributions RMDs at. If you want to convert assets from your 401 k or another employer-sponsored plan to a Roth IRA make sure the money is. Now lets say you decide to convert that IRA to a Roth two years later in 2018.

If you dont have any. 5000 of income minus zero for the deduction. You may be able to do a rollover of 401 k 403 b or other employer-sponsored retirement funds to a Roth if you are no longer working for the company but as with the traditional-IRA-to-Roth.

If you do not expect to need the funds at age 72 and beyond a Roth IRA can be a great way to allow for longer-term tax-free growth and serve as a legacy planning tool to pass wealth to the next generation. You can convert a traditional IRA to a Roth IRA at any time. When to Convert Your Traditional IRA to a Roth.

In the case of a conversion 5 years must pass since the conversion. The fact that you are filing jointly now and either you or your spouse will likely be filing as single later means that now might be a good time to make a Roth IRA conversion. This strategy works best if you dont have an existing traditional IRA.

If youre in a 33. If you contributed 5000 to a traditional IRA in 2016 and received no deduction for that contribution your basis in those funds would be 5000.

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Now Is The Best Time In History To Do A Roth Ira Conversion

Now Is The Best Time In History To Do A Roth Ira Conversion

Systematic Partial Roth Conversions Recharacterizations

Systematic Partial Roth Conversions Recharacterizations

2010 The Year Of The Roth Conversion

2010 The Year Of The Roth Conversion

Should You Convert Retirement Account To A Roth Account During The Covid 19 Pandemic

Should You Convert Retirement Account To A Roth Account During The Covid 19 Pandemic

Converting Your Traditional Ira Janus Henderson Investors

Converting Your Traditional Ira Janus Henderson Investors

How To Access Retirement Funds Early

How To Access Retirement Funds Early

How To Access Retirement Funds Early

Roth Ira Conversions When Why And How To Convert A Traditional Ira To A Roth Ira Yield Hunting

Roth Ira Conversion What To Know Before Converting Fidelity

Roth Ira Conversion What To Know Before Converting Fidelity

When It S A Bad Deal To Inherit A Roth Ira

When It S A Bad Deal To Inherit A Roth Ira

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Comments

Post a Comment