Ask the bank to reverse it. For example if your current balance is 6000 but your credit limit was reduced to 5000 you can not be charged a fee for being over your credit limit for 45 days.

Can My Credit Card Limit Get Reduced Without Notice

Can My Credit Card Limit Get Reduced Without Notice

The debt-to-limit ratio is calculated by dividing what consumers spend each month by their credit limit and its a key component of credit scores.

Credit limit reduced without warning. I have 8 Credit cards. A 2008 survey of senior loan officers conducted by the Federal Reserve found that 20 of banks reduced credit limits on existing credit-card accounts to prime borrowers at the start of the Great. If playback doesnt begin shortly try restarting your device.

Measures to Take When Your Credit Card Limit Is Lowered without a Warning Immediately Contact Your Credit Card Company for Explanation. When a lender decreases your credit limit by surprise what can you do about it. Dinner or Date night activitie.

Earlier this week Chase sent me a letter which read in part. Here are 4 things you can do if your credit limit is reduced. A bank or Credit Card issuer can generally lower or increase your credit limit at any time as long as its allowed in the Credit Card agreement.

Sometimes the card issuer can also lower the credit limit to better fit your usage if you have not been using a significant portion of the credit limit. Reducing the limit will not be subject to any notice period for any financial product anywhere - as an example if you had a credit card with 10000 available credit left and you called them to tell them you cant afford to pay the balance already on there do you think they are going to give you 30 days to blow the other 10k when you cant afford to pay back what you already owe. The site estimates that nearly 50 million credit card customers may have been affected by similar decisions.

Reasons why card issuers might reduce credit card limits without warning include. And how does it affect your credit score. My credit limit was almost cut without warning.

I have called the complaints department numerous times as well as emailed but have received no explanation for this. They dont have to provide any explanation See related. Because of your limited usage were lowering your limit to 6200 30 days from the date of this letter.

It would be somewhat similar to your monthly expenses charged to your credit card being 700 and your credit limit is 2000 and you paying your balance off in full the entire month and the credit card company without giving you any notice just decreases your credit limit to 700 and you going to the store only to have your purchases declined or your automatic credit card payment declined. In reviewing your credit card account we saw you spent far below your available credit limit in the last 12 months. I use each card for something specific 1.

It may seem unfair that a credit card company can lower your limit without warning but its not illegal. Credit Limit Decrease Reduced Without Warning Strategy Advice Watch later. Credit limit reductions can negatively affect a cardholders credit score.

If a consumer owes 1000 and has a 5000 credit limit they would be. Late payments If the issuer wants to reduce the overall amount its letting customers use Carrying a higher balance than normal If your card is inactive. In case your credit card company reduces your credit-card limit without giving you any heads-up you must immediately contact their representative and politely ask for a reason why they have done so.

Youve probably noticed that when your credit card company makes certain changes to your cards terms you get a written notice. If you do get charged a fee be sure to call your card issuer to get this fee waived as a result of the recent credit limit decrease. Hi My credit limit on the Virgin Money credit card has been halved without any explanation as to why this was done.

Plenty of actions require 45 days advance notice thanks to the CARD Act but changing a credit limit isnt one of them. A recent study from CompareCards found that one-quarter of respondents said their credit limit was decreased or their card was closed completely in the past month. I dont ever use 2 of the 8 and Im surprised the credit card companies havent done thaf to me with those but the 6 I do use.

However if your card issuer reduces your credit limit it usually happens without warning. It may not work but its worth a try. Ask another card company to raise your limit.

There are some rules and exceptions but generally speaking banks and issuers can increase your limit and decrease your limit without notice said Ruth Jackson Lee a consumer attorney based in Florida.

Credit Limit Decrease Reduced Without Warning Strategy Advice Youtube

Credit Limit Decrease Reduced Without Warning Strategy Advice Youtube

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-649660615-6d1084d40ecf4a09bb463441cc5fa790.jpg) What To Do When Your Credit Card Limit Is Lowered

What To Do When Your Credit Card Limit Is Lowered

Credit Card Limit Decreased Why It Happens And What To Do About It Creditcards Com

Credit Card Limit Decreased Why It Happens And What To Do About It Creditcards Com

Your Credit Card Limit Can Be Lowered Without Warning What To Do If This Happens Fox Business

Your Credit Card Limit Can Be Lowered Without Warning What To Do If This Happens Fox Business

Barclaycard Cuts Customers Spending Limits By More Than 85 This Is Money

Barclaycard Cuts Customers Spending Limits By More Than 85 This Is Money

What To Do If Your Credit Limit Gets Cut The Simple Dollar

What To Do If Your Credit Limit Gets Cut The Simple Dollar

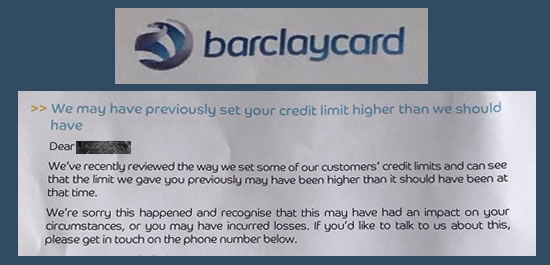

Barclaycard Send Letters Saying They Raised Credit Limits Too High Debt Camel

Barclaycard Send Letters Saying They Raised Credit Limits Too High Debt Camel

Can Your Credit Limit Be Lowered Without Warning What To Do

Can Your Credit Limit Be Lowered Without Warning What To Do

Can Credit Card Companies Reduce Your Credit Limit Without Warning Bankbazaar The Definitive Word On Personal Finance Can Credit Card Companies Reduce Your Credit Limit Without Warning

Can Credit Card Companies Reduce Your Credit Limit Without Warning Bankbazaar The Definitive Word On Personal Finance Can Credit Card Companies Reduce Your Credit Limit Without Warning

Can Credit Card Companies Reduce Your Credit Limits Creditrepair Com

Can Credit Card Companies Reduce Your Credit Limits Creditrepair Com

Credit Card Issuers Are Lowering Credit Limits Without Warning Youtube

Credit Card Issuers Are Lowering Credit Limits Without Warning Youtube

Credit Card Limit Reduced Without Warning Find Out Why Finserv Markets

Credit Card Limit Reduced Without Warning Find Out Why Finserv Markets

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

Comments

Post a Comment