Tell your mortgage lender if you are suffering a financial hardship -- you may have lost a job or suffered a serious injury that has eaten away at your monthly income -- and that you need to lower your interest rate to afford your monthly mortgage payments. Re-amortizing or recasting is a great way to lower your monthly payment without refinancing.

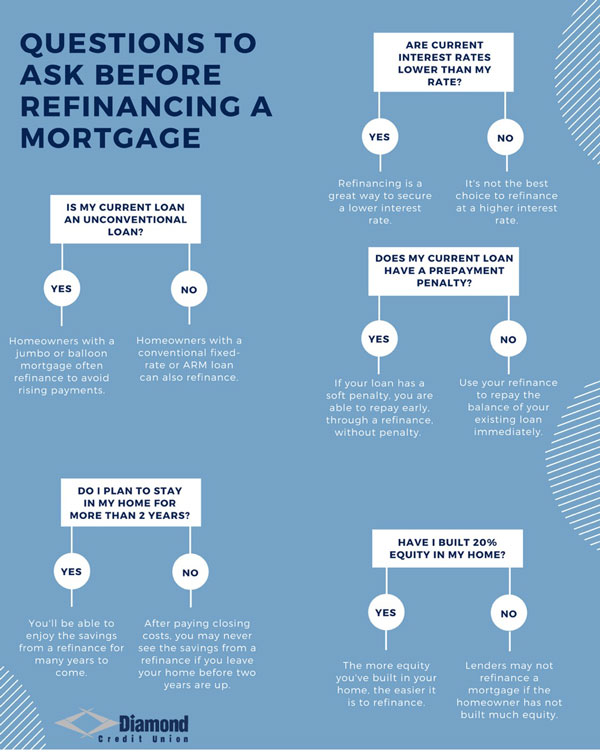

Should You Refinance Your Mortgage Yes Or No Diamond Cu

Should You Refinance Your Mortgage Yes Or No Diamond Cu

I would like to remain a loyal customer with your company.

How can i get my mortgage interest rate lowered. Maintain a good credit score. But refinancing turns the amortization clock back to square one and also gobbles a few thousand in closing costs so a small difference between your old and new interest ratessay 025 percentmight not be justified. This is the department that has the power to reduce a mortgage interest rate.

You tell us the interest rate you would like to PreFi at and well tell you the prepayment amount youll need to hit that figure -- whether by regular monthly prepayments or a one. How to get a lower mortgage interest rate 1. If it costs 2000 to lower your rate 05 percentage points make sure youll be in the home long enough to get that 2000 back in interest.

Dont hesitate to look into getting a better interest rate on your mortgage. Watch the market to see how the interest rates are going up and down. You need to indicate that you have no interest in refinancing with them because otherwise theyll just take you down that route.

To get the best deal you can follow these steps to get a lower mortgage interest rate. If you are currently on a variable-rate mortgage your rate goes up and down with the. Typically mortgages are quoted with 30-day locks.

You dont need to refinance your mortgage to do this because most lenders will simply offer this service for a fee of about 250. You can extend it back to a 30-year fixed-rate mortgage and since your loan balance is smaller than it. Just make sure the break-even point makes sense for your goals.

Peter Riches In fact a difference in rates for a 700000 home loan at 44 per cent versus 39 per cent will. When you refinance make sure you choose a fixed-rate mortgage. The newer the mortgage the stronger the argument that you should consider refinancing.

When the market reaches rates that are lower than what youre paying thats a good time to refinance1 X Research sourceStep 2 Pick a fixed-rate rate over a variable one. Similarly if your interest rate is cut then your monthly repayments will decrease. Our Prepayment Refinance Calculator PreFi SM allows you to plug in a dollar amount and tells you what equivalent-to-refinancing interest rate that prepayment will achieveThis LowerRate prepayment calculator does the reverse.

While not conventional or at all common some folks have obtained lower interest rates simply by calling up their mortgage lender and requesting one. If you find yourself falling behind in making your mortgage payments being honest with your lender may get you a lower interest rate without you having to refinance a new loan. Your mortgage interest rate plays a major part in determining how affordable your loan is and the easiest way to trade a higher rate for a lower one is through a mortgage refinance.

If you can not extend a reduction offer please advise as soon as possible as I am considering accepting several offers from other card companies who are offering much lower interest rates as well as balance transfer. There is one way you can get a lower mortgage interest rate without refinancing however. Call your lender and ask to speak to the loss mitigation department.

You can use RateCity cash rate to check how the latest interest rate change affected your mortgage interest rate. Here are 10 ways you may be able to lower your mortgage rate. Step 1 Choose a time period with lower interest rates.

I would appreciate your consideration of a lowered rate at this time. When your rate rises you will be required to pay your bank more each month in mortgage repayments. If you extend your 15-year mortgage to a 30-year mortgage your monthly mortgage payment will decrease since you have.

You can pay upfront to buy discount points in order to secure a lower mortgage rate. It can also be to your advantage to refinance to a lower mortgage interest rate even when you are managing your finances well. However youll need to make sure that youre maximizing your opportunity and complying with all of the relevant laws that govern these situations and some of them are quite new.

However you do it lowering the interest rate on your mortgage is obviously a positive step to take. This process involves extending your mortgage term. If you lock for 60 days youll pay higher fees about one-quarter to one-half percent of your loan amount extra for a 60-day lock.

Explain you are going through a financial. The foundation of a low mortgage rate begins with keeping your credit score as high as possible.

6 Ways To Lower Your Interest Rate Total Mortgage Blog

6 Ways To Lower Your Interest Rate Total Mortgage Blog

/find-and-compare-best-mortgage-rates-4148342_FINAL-d90ea8095a49474f90bee793bf4c5918.png) Is A 15 Year Better Than A 30 Year Mortgage Comparison

Is A 15 Year Better Than A 30 Year Mortgage Comparison

Should You Wait For Lower Rates

What Your Mortgage Interest Rate Really Means Money Under 30

What Your Mortgage Interest Rate Really Means Money Under 30

Mortgage Rates Today Are Extremely Low Here S How To Lock In The Cheapest Loan Rate Fox Business

Mortgage Rates Today Are Extremely Low Here S How To Lock In The Cheapest Loan Rate Fox Business

Should You Wait For Lower Rates

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Should I Wait For Lower Mortgage Interest Rates Keeping Current Matters

Should I Wait For Lower Mortgage Interest Rates Keeping Current Matters

Can I Lower My Mortgage Interest Rate Without Refinancing The Truth About Mortgage

Can I Lower My Mortgage Interest Rate Without Refinancing The Truth About Mortgage

3 Ways To Lower Your Mortgage Interest Rate Wikihow

3 Ways To Lower Your Mortgage Interest Rate Wikihow

Can I Lower My Mortgage Interest Rate Without Refinancing

Can I Lower My Mortgage Interest Rate Without Refinancing

Lower Your Monthly Payments Without Refinancing Recast

Lower Your Monthly Payments Without Refinancing Recast

Should I Refinance My Mortgage How To Pay It Off Faster With A Lower Interest Rate Delucia Co

Should I Refinance My Mortgage How To Pay It Off Faster With A Lower Interest Rate Delucia Co

Comments

Post a Comment