Private Insurance Tax Credit. Employee-paid premiums to a private health services plan are considered qualifying medical expenses and can be claimed by the employee on their income tax and benefit return.

Private Health Insurance Premiums And Federal Policy Congressional Budget Office

Private Health Insurance Premiums And Federal Policy Congressional Budget Office

Private Insurance Tax Credit Program.

Private insurance premiums. In the past insurers would price your health insurance based on any number of factors but after the Affordable Care Act the number of variables that impact your. You are self employed. Regardless of the value of a home most mortgage insurance premiums cost between 05 and as much as 5 of the original amount of.

If youre refinancing with a conventional loan and your equity is less than 20 percent of the value of your home PMI is also usually required. But the tax-advantaged benefits of group health insurance premiums and health reimbursement arrangements were not available to be used in order to reimburse employees for individual health insurance premiums. We shop all the options for your property in your region to ensure you are getting the best premium.

The average cost of a family plan is. You will NOT need to pay the full premium and be reimbursed later unless you choose that option. Medicare Part A and Part B are known as Original Medicare also called traditional Medicare.

Generally all companies that sell mortgage insurance price their policies this way. The premium you pay each month to the insurance carrier is the subsidized premium the amount remaining after all tax credits and discounts have been applied. By Sterling Price Reviewed by licensed agent Brandy Law updated March 5 2021.

Its provided by the federal government. PMI is usually required when you have a conventional loan and make a down payment of less than 20 percent of the homes purchase price. You are enrolled in a health plan but the premiums are too high.

It is called Private flood insurance most notably Lloyds of London Flood insurance however there are other options available in Idaho. Insurance can be confusing. If you can afford to pay more in monthly premium costs in exchange for small medical expenses related to extensive ongoing health care the Platinum plan may be a good choice.

You are enrolled in a health plan but your benefits needs have changed. Part A is hospital insurance and most people dont have to pay a. For family coverage the average premium is 1437 per month.

Furthermore any premium contribution or other consideration including sales and premium taxes that you pay to. Idaho private flood insurance market There are alternatives to the NFIP or government insurance. The average monthly cost of health insurance in the United States is 495.

As a rule premiums that are paid to private health services plans including medical dental and hospitalization plans are considered to be eligible medical expenses by the Canada Revenue Agency. 1 day agoThe 37 insurance companies that belong to the private sector acquired 625 of the total premiums collected during January and February at a value of EGP 475bn. Private insurance and Medicare.

Include the amount that the employee paid on a T4 slip in the Other information area. Health insurance tax credits created by the Affordable Care Act and paid to insurers to help eligible Idahoans with monthly insurance premiums. The national average Gold plan premium in 2020 for single coverage is 569.

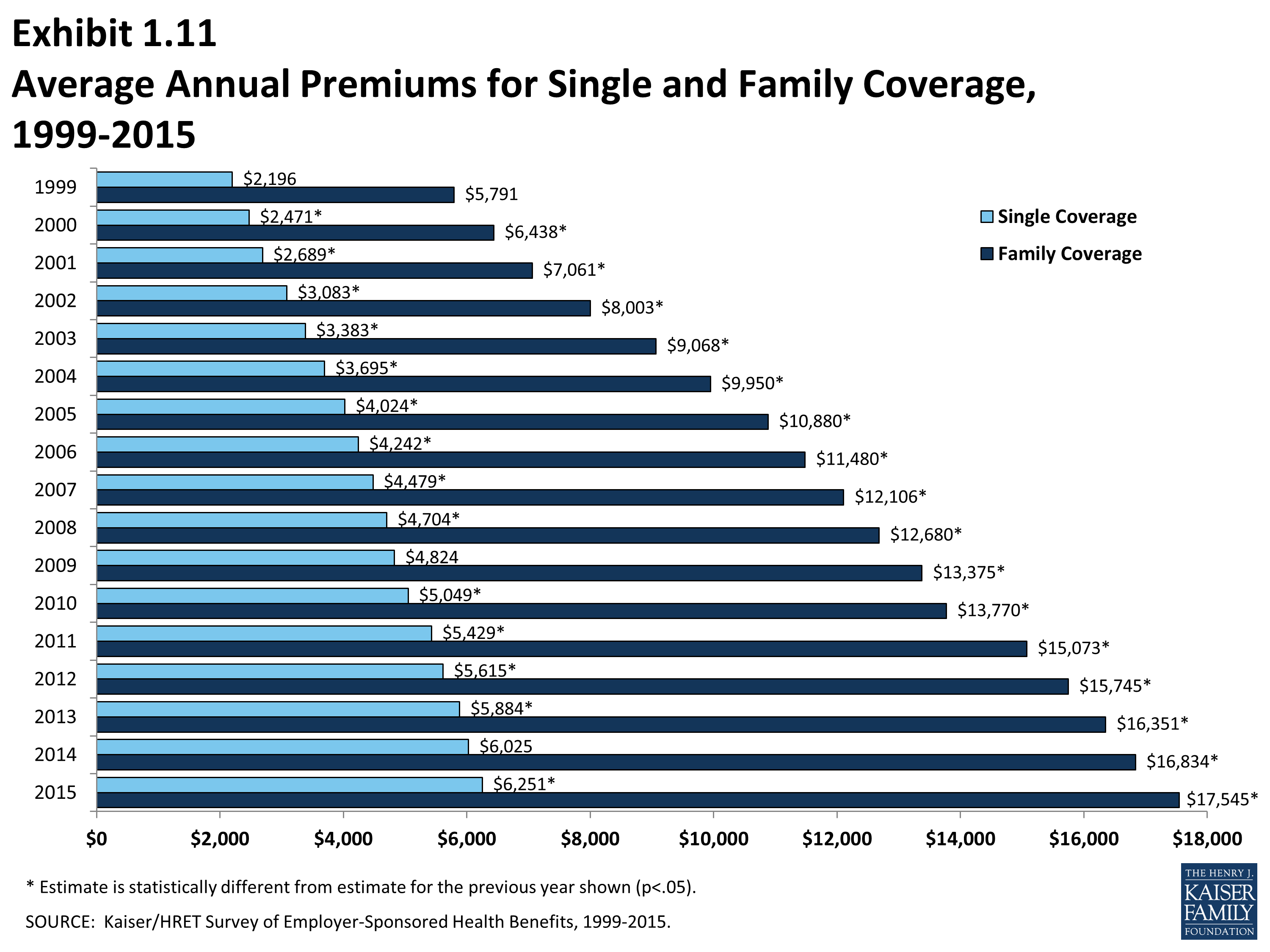

Annual premiums for employer-sponsored family health coverage include a modest increase 4 percent in the average premiums for both single and family coverage in the past year. Private health insurance is sold by private insurance companies not by the government. The cost of private mortgage insurance PMI is based on the loan amount the borrowers creditworthiness and the percentage of a homes value that would be paid out for a claim.

Your Health Idaho is an online marketplace that allows Idaho families and small businesses to shop compare and choose the health insurance coverage thats right for them. Daniel has 10 years of experience reporting on investments and personal finance for. You are enrolled in a group plan but it does not cover spouses or dependents.

YHI was established following the passage of the Patient Protection and Affordable Care Act ACA in 2010. The average annual single coverage premium is 6251 and the average family coverage premium is 17545this year. Your employer does not offer a group plan.

Daniel Kurt is an expert on retirement planning insurance home ownership loan basics and more. Payments of Premiums for Private Health Services Plans. There was nothing preventing employers from giving their employees a raise or taxable bonus in lieu of providing health insurance benefits.

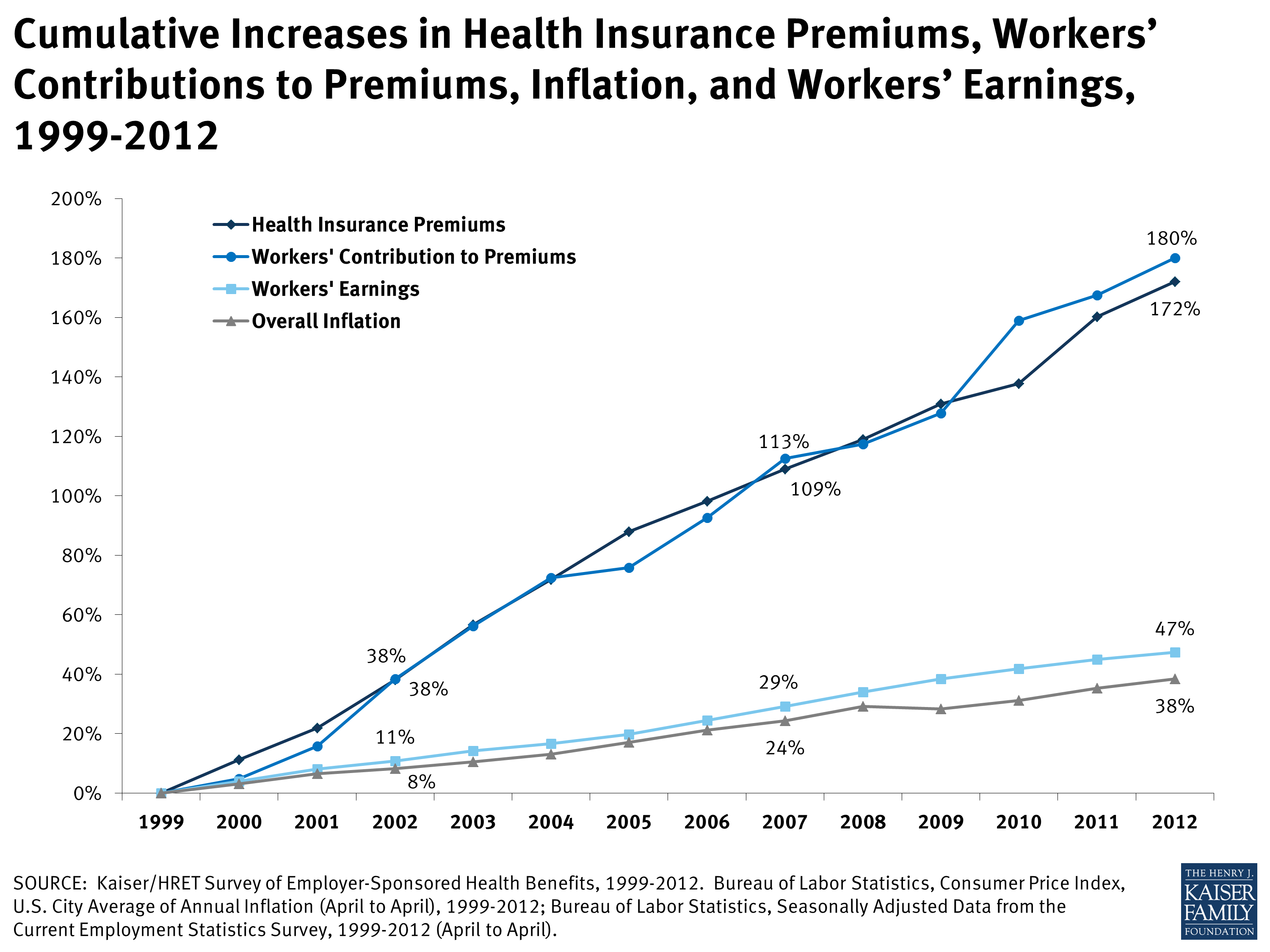

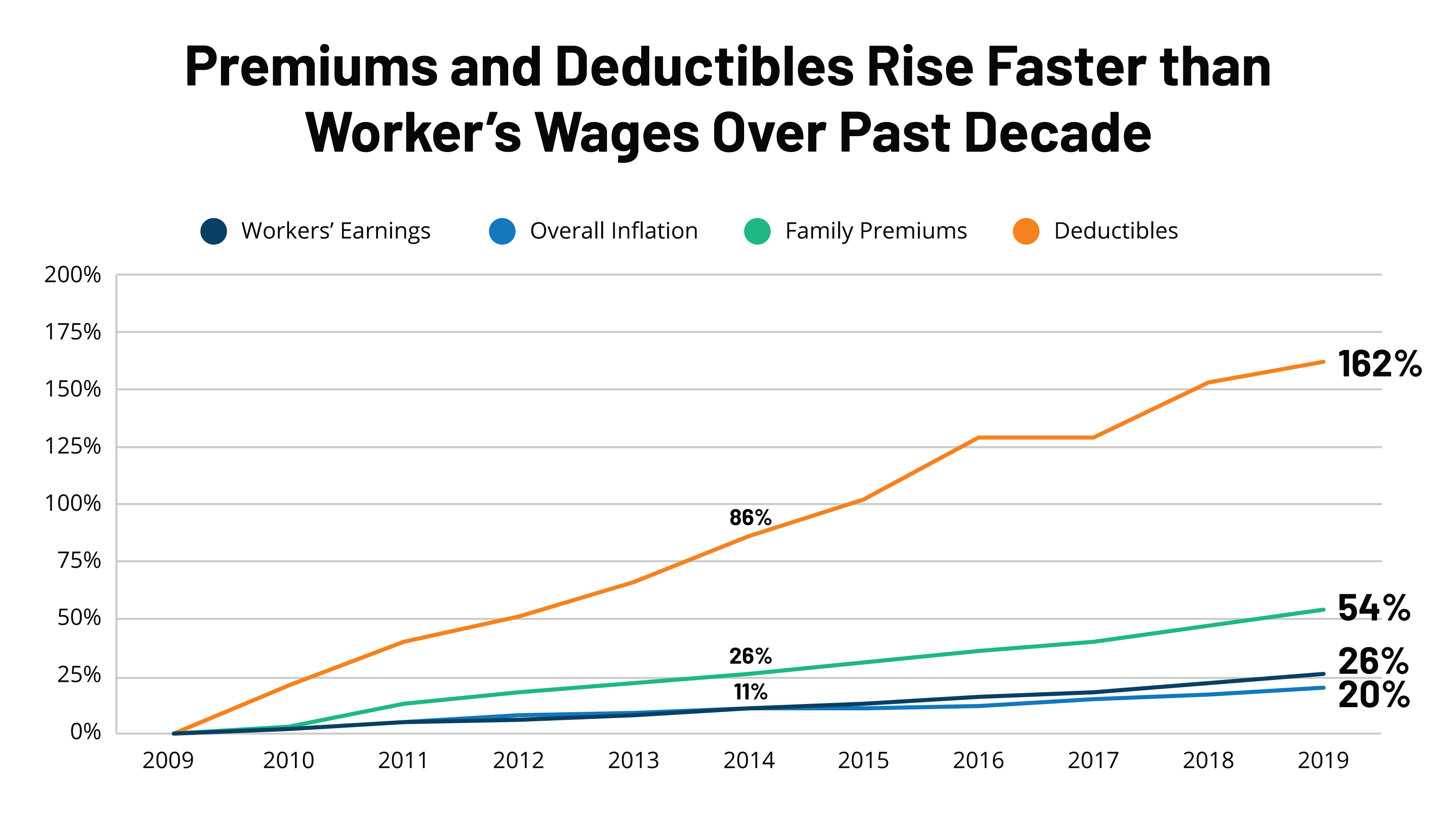

Health insurance premiums have risen dramatically over the past decade. According to eHealth Insurance the average cost of an individual plan purchased on your own is 440 per month. A new Idaho private health insurance plan may be right for you if.

Were here to help.

Cumulative Increases In Health Insurance Premiums Workers Contributions To Premiums Inflation And Workers Earnings 1999 2012 Kff

Cumulative Increases In Health Insurance Premiums Workers Contributions To Premiums Inflation And Workers Earnings 1999 2012 Kff

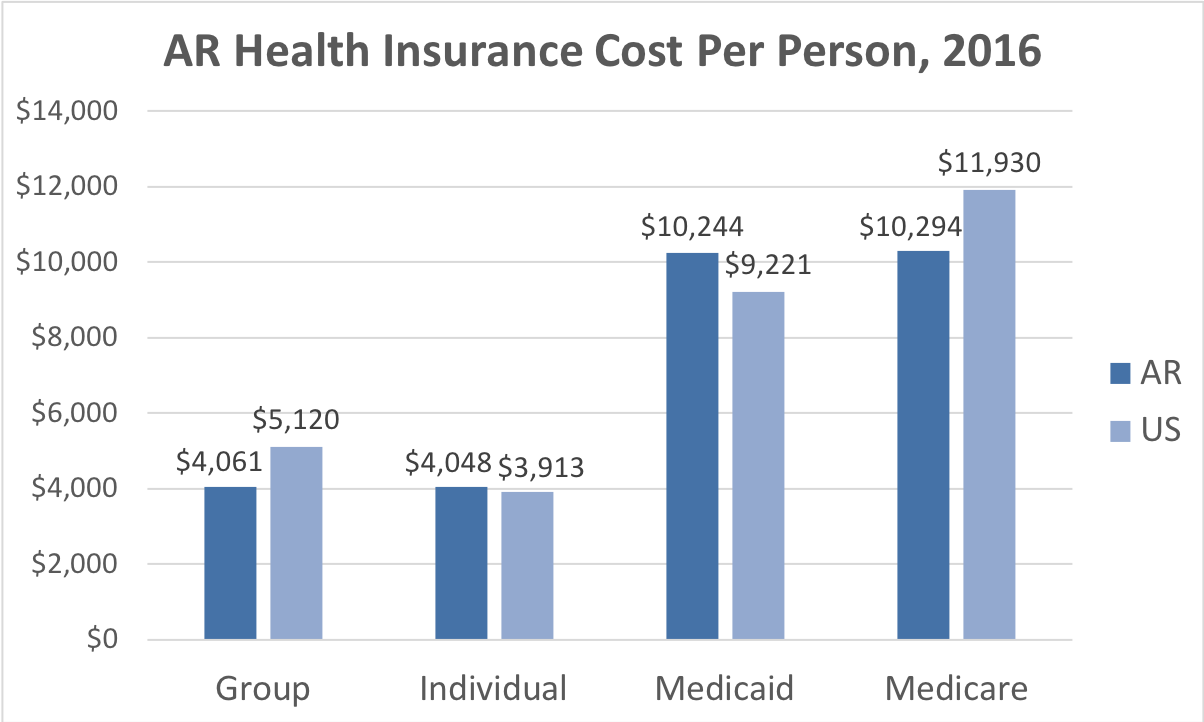

Arkansas Health Insurance Valchoice

Arkansas Health Insurance Valchoice

How Age Affects Health Insurance Costs Valuepenguin

Why My Health Insurance Premiums Are Increasing 56 Next Year

Why My Health Insurance Premiums Are Increasing 56 Next Year

What Is The Average Cost Of Small Business Health Insurance Ehealth

What Is The Average Cost Of Small Business Health Insurance Ehealth

Average Private Sector Employer Sponsored Health Insurance Premiums 2018 Agency For Healthcare Research And Quality

Average Private Sector Employer Sponsored Health Insurance Premiums 2018 Agency For Healthcare Research And Quality

How To Buy Health Insurance If You Don T Qualify For A Subsidy Ehealth

How To Buy Health Insurance If You Don T Qualify For A Subsidy Ehealth

Health Insurance Premiums And Increases

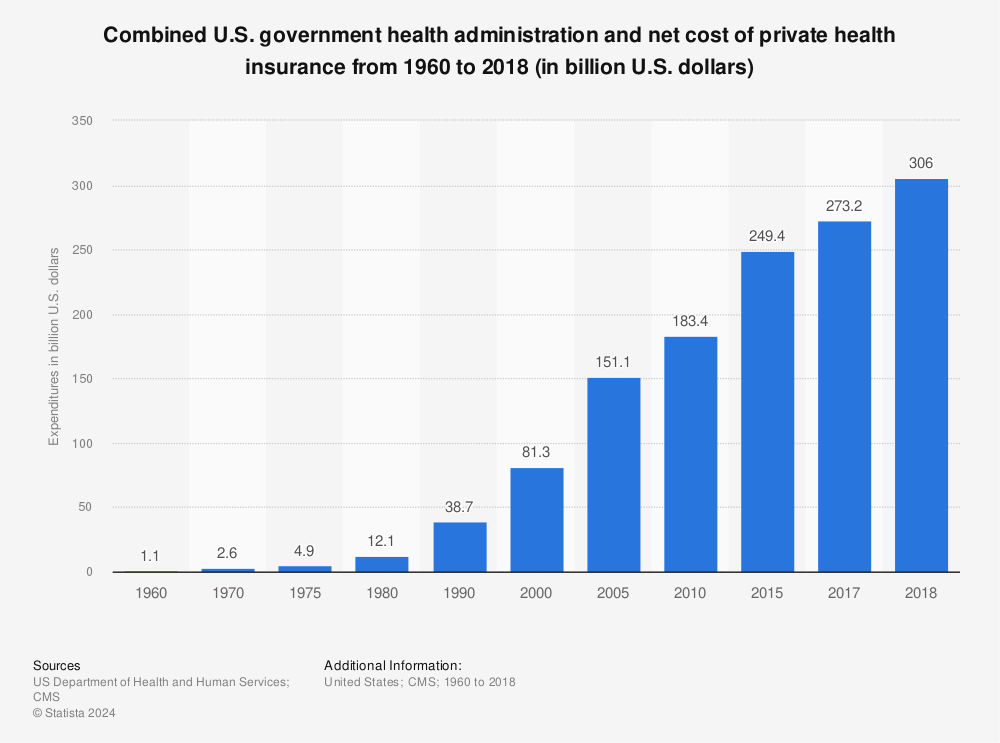

U S Health Administration Costs And Private Health Insurance 1960 2018 Statista

U S Health Administration Costs And Private Health Insurance 1960 2018 Statista

Section 1 Cost Of Health Insurance 9335 Kff

Section 1 Cost Of Health Insurance 9335 Kff

How Obamacare Affects Health Insurance Premiums

How Obamacare Affects Health Insurance Premiums

How Much Does Individual Health Insurance Cost Ehealth

How Much Does Individual Health Insurance Cost Ehealth

Health Insurance Premiums Average Annual Cost 19 000 Family 6 000 Individual My Money Blog

Health Insurance Premiums Average Annual Cost 19 000 Family 6 000 Individual My Money Blog

Ehbs 2015 Section One Cost Of Health Insurance 8775 Kff

Ehbs 2015 Section One Cost Of Health Insurance 8775 Kff

Comments

Post a Comment