You take a distribution from your traditional IRA or 401 k and contribute that money into a Roth IRA. Talk to a teller or broker and let him know that you want to convert your SEP IRA and transfer its funds to the Roth IRA account youve created.

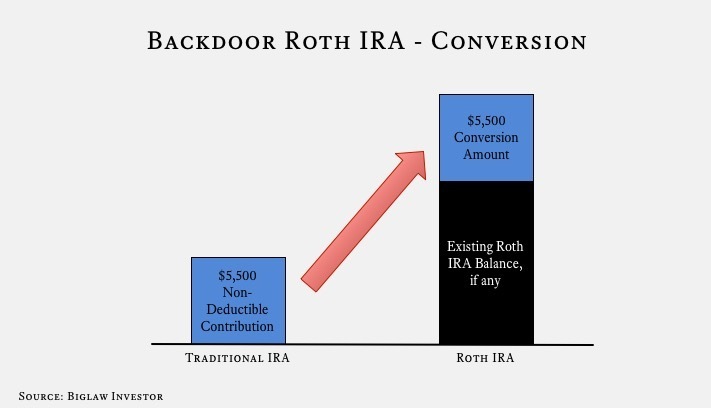

Backdoor Roth Ira A How To Guide Biglaw Investor

Backdoor Roth Ira A How To Guide Biglaw Investor

You can indeed change funds in a Roth IRA free from any federal tax consequence whatsoever as long as that money remains within the Roth IRA.

Change ira to roth. Historically low tax rates make 2021 a great time to convert your traditional IRA to a Roth account. Youll need to wait until your Roth IRA account is opened before you can begin the transfer from your SEP IRA. If you had been able to do a Roth conversion youd pay taxes on the amount of money converted today and never pay taxes on.

The IRS describes three ways to go about it. Determine the tax youll owe when you convert. You generally have to include the amount you convert in your gross income for the year of conversion but any nondeductible contributions youve made to your traditional IRA wont be taxed when you convert.

When you convert a traditional IRA to a Roth IRA it is not considered a contributionso Roth conversion amounts are not subject to the limits above. You can even keep them in the same investments. While everyones risk tolerance retirement horizon and lifestyles are different most everyone is interested in saving money on taxes.

Converting all or part of a traditional IRA to a Roth IRA is a fairly straightforward process. The Roth IRA conversion works this way. This is called a backdoor IRA.

There are lots of good reasons to make the switch but watch out for the taxes. All youre doing is changing the type of account that holds them. However before you make a lot of trades there are certain restrictions and other considerations that may apply.

There are innumerable ways in which Congress could change Roth IRAs including. Bidens Expected 434 Tax Plan Is Another Reason to Max Out Your Roth IRA Now If you want to eliminate a tax headache later consider making a direct contribution to a Roth IRA. You can keep your funds at the same financial institution.

Youll need to identify yourself as the account holder and youll be given. A rollover in which you take a distribution from your. Since you have already paid income tax on contributions to a Roth IRA you generally have no further federal tax.

Prior to 2010 only those account owners who had a modified adjusted gross income below 100000 were eligible to convert. You open a traditional IRA and put the funds in there and then youre allowed to convert it to a Roth account. You can convert your savings from either a deductible or nondeductible IRA to a Roth IRA by simply telling your bank or other financial institution that you want to do so.

Inherited IRAs cant be converted into Roth IRAs. How to Change a Traditional IRA to a Roth Step 1. Subtract any IRA contributions you didnt deduct from the current.

A Roth IRA rollover transfers money from a traditional IRA into a Roth. There are no income limits or restrictions based on your tax filing status. Its the best time in history to convert to a Roth says Elijah Kovar co-founder of Great.

Anyone can convert their eligible IRA assets to a Roth IRA regardless of income or marital status. Visit the bank or brokerage where your SEP IRA is held. Roth IRAs are also not subject to Required Minimum Distributions.

There are income limits when contributing to a Roth IRA but there are no income limits when converting a Traditional IRA to a Roth IRA. Amounts contributed to a Roth IRA can always be withdrawn at any time. Determine how much of your Traditional IRA youll be able to convert to a Roth.

Converting certain IRA assets to Roth IRA assets can help boost after-tax retirement income and reduce future required minimum distributions RMDs at age 72 since RMDs do not apply to Roth IRAs. Youre going to have to pay tax. Prior to 2010 if your income was over 100000 you could not convert IRA money to a Roth.

Make distributions taxable for Alternative Minimum Tax. Anyone can convert a traditional IRA to a Roth IRA in 2020.

How To Access Retirement Funds Early

Roth Ira Conversion What To Know Before Converting Fidelity

Roth Ira Conversion What To Know Before Converting Fidelity

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

Systematic Partial Roth Conversions Recharacterizations

Systematic Partial Roth Conversions Recharacterizations

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

2010 The Year Of The Roth Conversion

2010 The Year Of The Roth Conversion

Mega Backdoor Roth Convert Within Plan Or Out To Roth Ira

Mega Backdoor Roth Convert Within Plan Or Out To Roth Ira

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

How To Do A Backdoor Roth Ira Contribution Safely

How To Do A Backdoor Roth Ira Contribution Safely

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

How To Do A Backdoor Roth Ira Contribution Safely

How To Do A Backdoor Roth Ira Contribution Safely

How To Access Retirement Funds Early

How To Access Retirement Funds Early

Comments

Post a Comment