There are options available. Clark says the reason you want to get something to the IRS is because of the way that taxpayers are penalized.

What To Do If You Owe The Irs And Can T Pay

What To Do If You Owe The Irs And Can T Pay

And you wont miss a payment or pay late.

/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png)

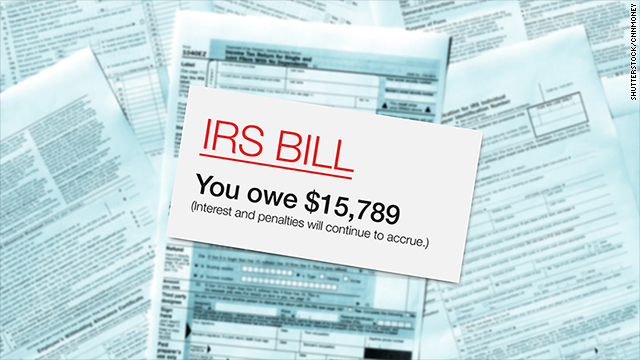

What if you owe the irs and can t pay. Visit the Taxpayer Advocate Service Tax Toolkit for more information on these. According to the Internal Revenue Service IRS those who cant afford to pay their full tax bill up front have three options. Unfortunately an IRS payment plan wont prevent you from accruing penalties and interest on the amount you owe but it does lower the penalties by half.

With this option there are no checks to write or send. These forms provide an in-depth analysis of your assets as well as your income and expenses to help determine what you can pay on a regular basis. If you owe the IRS an unexpected tax bill Consumer Reports explains your payment options.

You would rather not even see how bad it is because if you open the mail you know a number and theres just no possible way you can pay that number deal with that. The penalty for failure to file is massive. The IRS would prefer working with you to ensure youre meeting your legal obligations than punish you regardless of their status as a federal institution that instills fear and collects debt.

If this happens there are options to help you meet your federal tax obligations. What to Do If You Owe the IRS and Cant Pay. For example if the financial statement shows that you can only afford.

Changes you can make online include revising payment dates payment amounts and banking information for Direct Debit Installment. Under the IRS Fresh Start initiative individuals who owe 50000 or less in income tax and businesses that owe 25000 or less in payroll tax may qualify. If you are one of these people how you decide to handle this debt could either soothe your anxiety or send you on an expensive journey that ends with more heartache than help.

You can set up a monthly installment agreement with the IRS allowing you to pay what you owe over time. In that case you need to look for ways to cut your expenses. You can even decide how much you want to pay per month at least to some extent.

If the IRS approves your long-term payment plan installment agreement a setup fee may apply depending on your income. The best way to apply is to use the IRS. The agency provides programs to help if you cant pay your taxes in full by April 15.

Do you owe money to the IRS but cant pay it now. It will also keep the IRS from coming. If youre in a state where youre unable to pay your tax debts theres no need to be afraid.

Reduce Your Energy Bills. If you owe a sizable debt to the IRS and dont have the money to pay it your problem may not be earning too little money but spending too much of what you make. If you already have a payment plan you may also qualify to use the online payment plan option to revise your existing agreement.

The penalty for failure to pay is actually pretty small. That property can be sold to pay for the tax debt. Unplug electrical devices when theyre not in use use timers and power.

If you need longer than 72 months to pay your debt or you owe more than 50000 the IRS will request a Collection Information Statement Form 433-A Form 433-B or Form 433-F. What to do if you owe the IRS cant pay your taxes. If you owe 50000 or less you can apply for an installment agreement.

If you are one of these people how you decide to handle this debt. If you cant pay anything you can ask to be put in a status called Currently Not Collectible Its a recognition from the IRS that you cant afford to pay anything right now. The Internal Revenue Service recognizes that some unforeseen events may result in owing tax you cant pay when you file your return.

A seizure or levy is the governments legal right to take the property you own or the rights to that property to settle the debt owed. Submit your return on time and pay as much as you can with your tax return. File your tax return and pay what you can If you cant pay the full amount of taxes you owe dont panic.

It can seize the wages you have in your bank account too to pay down what you owe. The entire balance has to be paid off within 72 months so your minimum payment would be. The Washington Post - May 17 is National Tax Day but its also a day of reckoning for millions of people who owe money to the IRS but cant pay.

Here are a few ideas for decreasing the amount you spend each month. Enrolling in a payment plan settling the debt for less or requesting. You may choose to make convenient monthly direct debit payments for up to 72 months.

What If I Can T Pay My Taxes Repaying The Irs Centsai

What If I Can T Pay My Taxes Repaying The Irs Centsai

What Happens When You Can T Pay What You Owe The Irs

What Happens When You Can T Pay What You Owe The Irs

What To Do If You Owe The Irs And Can T Pay

What To Do If You Owe The Irs And Can T Pay

What Happens If You Owe The Irs Money And Don T Pay The Hustler S Digest

What Happens If You Owe The Irs Money And Don T Pay The Hustler S Digest

What If You Owe The Irs Taxes And Can T Pay Them The National Interest

What If You Owe The Irs Taxes And Can T Pay Them The National Interest

Don T Panic If You Owe The Irs And Can T Pay Tax Law Expert Says There S Options

Don T Panic If You Owe The Irs And Can T Pay Tax Law Expert Says There S Options

What To Do If You Owe The Irs And Can T Pay Overview Youtube

What To Do If You Owe The Irs And Can T Pay Overview Youtube

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

What Is The Irs Debt Forgiveness Program Tax Defense Network

What Is The Irs Debt Forgiveness Program Tax Defense Network

/GettyImages-534311042-5762cb125f9b58f22edcb57d.jpg) What If You Can T Pay The Taxes You Owe

What If You Can T Pay The Taxes You Owe

What If I Can T Pay My Taxes Repaying The Irs Centsai

What If I Can T Pay My Taxes Repaying The Irs Centsai

What To Do If You Owe The Irs But You Can T Pay Personal Finance Us News

What To Do If You Owe The Irs But You Can T Pay Personal Finance Us News

/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png) What Happens If You Don T File Taxes

What Happens If You Don T File Taxes

What To Do If You Owe The Irs Back Taxes H R Block

What To Do If You Owe The Irs Back Taxes H R Block

Comments

Post a Comment