The work-related expenses budget has been increased in 2020 in connection with the coronavirus crisis from 17 per cent to 3 per cent for the first EUR 400000 of the wage bill. Self-only coverage will increase 50 to 3550.

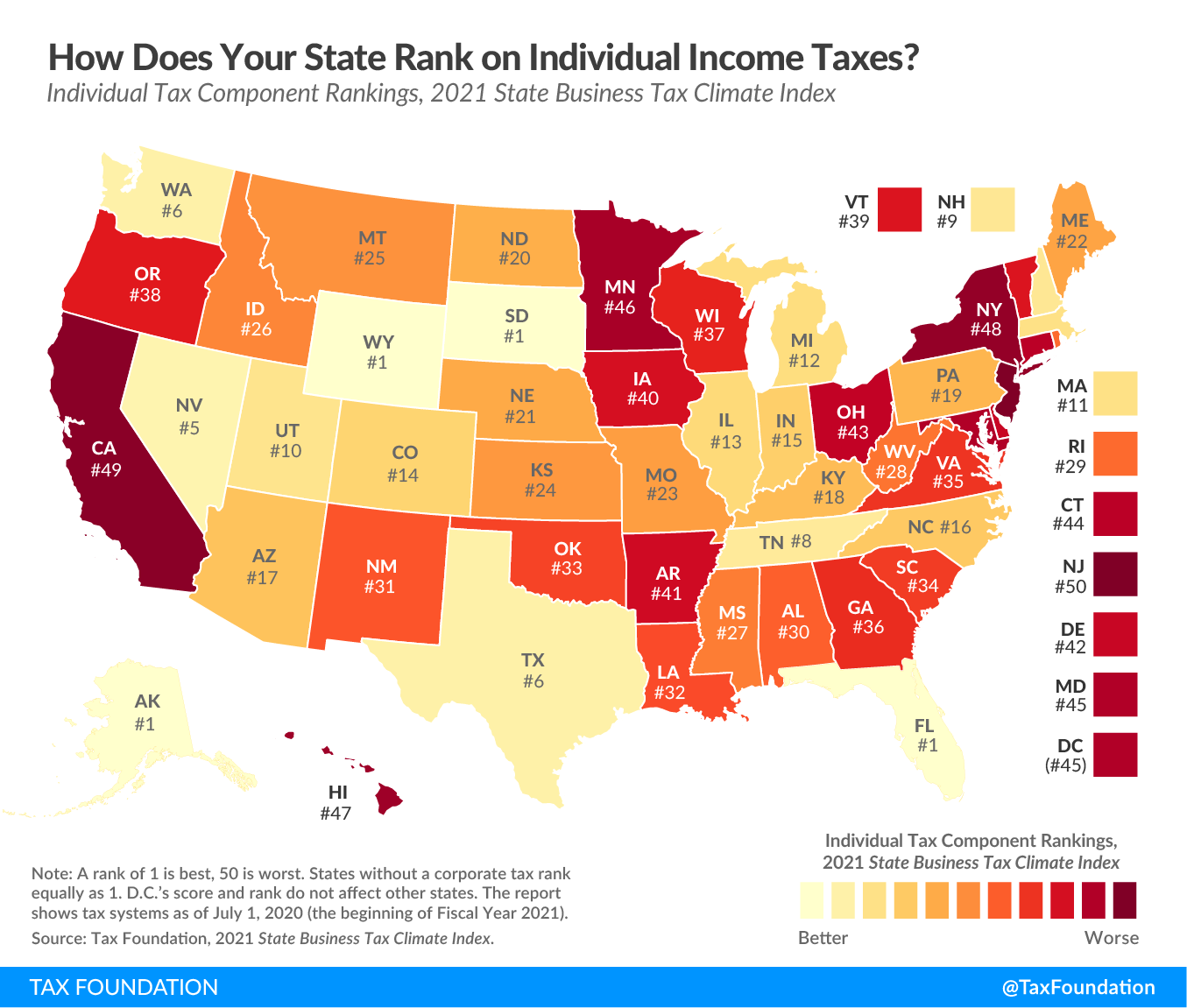

Best Worst State Income Tax Codes Tax Foundation

Best Worst State Income Tax Codes Tax Foundation

Higher Health Savings Account HSA Limits.

Taxes for 2021. The IRS has announced its inflation adjustments for 2021 taxes Standard Deduction. In 2021 taxpayers will still be able to use the tax deduction for training costs. Consult our free eBooks and articles.

The maximum Earned Income Tax Credit in 2021 for single and. Advertentie Aggressive strategies to get your tax rate below 10. Same Tax Rates but Higher Brackets.

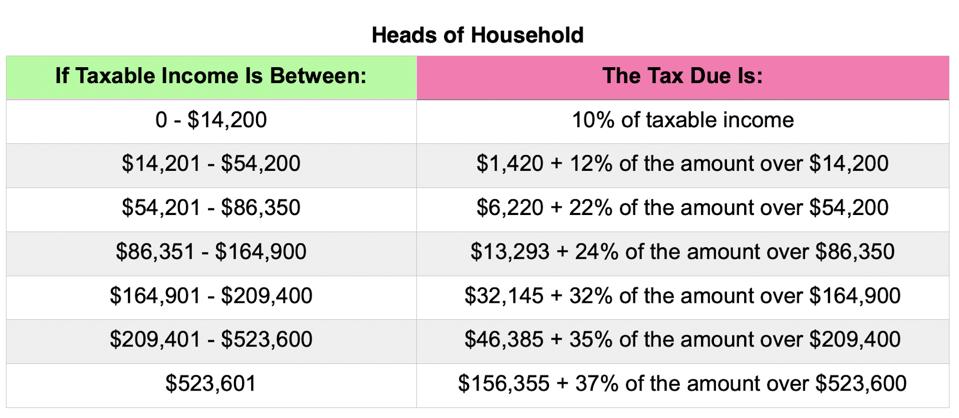

The top rate of 37 will apply to taxable income over 628300 for married. Family coverage will increase 100 to 7100. Attack your tax rate today.

The deadline for submitting tax returns and making tax payments has been extended to May 17 2021The extra time is intended to ease the burden on taxpayers who are dealing with the economic upheaval caused by the pandemic which has left millions without jobs or with reduced work hours. 8 rijen 2021 Earned Income Tax Credit. Tax filing in the pandemic Discussions are.

4 rijen PAYE tax rates and thresholds 2021 to 2022. Standard Deduction for 2021 Tax Year. Taxpayers have until the regular yearly deadline or April 30 2021 to file tax returns and pay taxes owed to the government for the 2020 income year.

The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The standard deduction for 2021 will be 25100 an increase of 300 for married couples filing. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

Consult our free eBooks and articles. WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. IRS Releases 2021 Tax Rates Standard Deduction Amounts And More Tax Brackets and Tax Rates.

Estimated quarterly taxes in 2021 will be due as follows. Tax day has been extended to May 17 2021. Attack your tax rate today.

In 2021 the Social Security tax rate is 62 for the employer and 62 for the employee. The IRS will be providing formal guidance in the coming days. 10 12 22 24 32 35 and 37.

Wage tax Change to work-related expenses budget. Advertentie Aggressive strategies to get your tax rate below 10. There are still seven 7 tax rates in 2021.

Medicare taxes are also split between the employer and the employee with a. How to calculate Federal Tax based on your Annual Income. Perhaps the best-known option is the IRSs Volunteer Income Tax Assistance VITA program available to people with incomes of 57000 or less those with disabilities or those who speak other languages.

To quickly catch you up to speed your taxes will differ in 2021 in the following ways. 242 per week 1048. Put in your zip code here to find a VITA.

The standard deduction amounts will increase to 12550 for individuals and married. Adjust your tax.

Tax Day 2021 When S The Last Day To File Taxes Kiplinger

Tax Day 2021 When S The Last Day To File Taxes Kiplinger

8 Ways Your Taxes Will Differ When You File In 2021

8 Ways Your Taxes Will Differ When You File In 2021

2021 Individual Taxes Answers To Your Questions About Limits Cornwell Jackson

2021 Individual Taxes Answers To Your Questions About Limits Cornwell Jackson

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

What You Need To Know About Your 2020 Taxes How You File In 2021 Tax Financial Planning Cpa Firm

What You Need To Know About Your 2020 Taxes How You File In 2021 Tax Financial Planning Cpa Firm

First Day To File Taxes 2021 Federal Income Tax Taxuni

First Day To File Taxes 2021 Federal Income Tax Taxuni

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Tax Return Vs Tax Refund How They Re Different What S Changed For 2021 Cnet

Tax Return Vs Tax Refund How They Re Different What S Changed For 2021 Cnet

When Are Taxes Due Tax Deadlines For 2021 Bankrate

When Are Taxes Due Tax Deadlines For 2021 Bankrate

Your First Look At 2021 Tax Rates Projected Brackets Standard Deductions More

Your First Look At 2021 Tax Rates Projected Brackets Standard Deductions More

Everything You Need To Know About Taxes 2021 Federal Income Tax Taxuni

Everything You Need To Know About Taxes 2021 Federal Income Tax Taxuni

Irs Tax Deadline 2021 Moved To May 17 Extending Tax Season By One Month Real Simple

Irs Tax Deadline 2021 Moved To May 17 Extending Tax Season By One Month Real Simple

Preparing For Potential Tax Changes In 2021 Tax Accountant Financial Planner

Preparing For Potential Tax Changes In 2021 Tax Accountant Financial Planner

Federal Income Tax Deadlines In 2021

Federal Income Tax Deadlines In 2021

Comments

Post a Comment