Under the new Sanders plan companies with large gaps between their CEO and median worker pay would see progressively higher corporate tax rates with the most unequal companies paying five percentage points more in corporate taxes. Sanders top marginal rate would return the estate tax to its historic high of 77 percentthe top rate that existed.

Bernie Sanders Proposes 8 Tax On Extreme Wealth To Help Middle Class Curb Power Of The Rich Marketwatch

Bernie Sanders Proposes 8 Tax On Extreme Wealth To Help Middle Class Curb Power Of The Rich Marketwatch

Sanders views higher taxes as a means to pay for bigger health-care housing education and climate-change programs and those plans would cost at least 40 trillion over a decade according to.

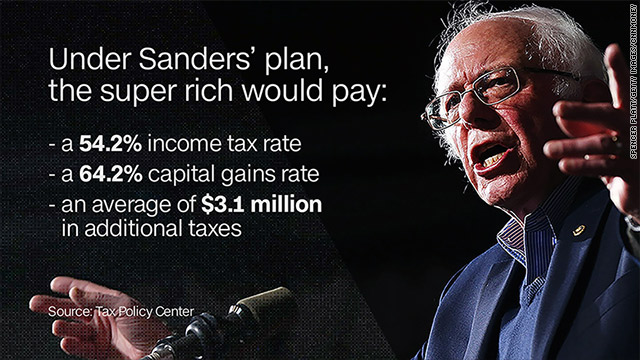

Bernie sanders higher taxes. Bidens tax hikes would prolong the economic downturn--Bernies would exacerbate this economic damage. Bernie Sanders is using his influence to push for even higher taxes. Those with taxable incomes above 250000 would pay a 50 capital gains tax.

250 million to 500 million. During his second presidential campaign Sanders had one of the most aggressive stances toward taxing the wealthy. Bernie Sanders calls for higher taxes on companies with wide pay gaps US.

1 percent marginal tax rate. Jen Ellis the lady behind the iconic and apparently very warm mittens said in an interview with the press that it just wasnt worth it to continue doing business even part time. Sanders Warren Want to Raise Taxes to Rein In Excessive CEO Pay Companies that pay their chief executives at least 50 times more than the typical employee would face higher taxes under a new bill offered Wednesday by Senators Bernie Sanders and Elizabeth Warren.

Sanders had about 393000 in book income last year and he and his wife reported giving nearly 19000 to charity. In 2018 Sanders adjusted gross income was 561293. Today Senator Bernie Sanders I-VT introduced a plan to make the estate tax more progressive in hopes that this wealth transfer tax will raise as much as 315 billion over ten years and as much as 22 trillion from the estates of current billionaires after their passing.

Presidential candidate Bernie Sanders on Monday laid out a plan to hike taxes on big companies with wide pay gaps. Presidential candidate Bernie Sanders on Monday laid out a plan to hike taxes on big companies with wide pay gaps between executives and rank-and-file workers. One plan would raise the corporate tax.

32 million to 50 million net worth. Sanders plan would raise tax rates on companies where the chief executive officer or highest-paid employee earns more than 50 times the median worker salary. CNBCs Robert Frank reports on presidential candidate Bernie Sanders new income inequality tax.

50 million to 250 million. He paid a 26 percent effective tax rate on that adjusted gross income. Places with high real-estate costs often have high property or real-estate taxes.

Bernie Sanderss wealth tax proposal. Senator Bernie Sanders has proposed expanding the federal estate tax by lowering the exemption to 35 million for singles and 7 million for married couples as well as creating four new brackets with marginal rates up to 77 percent. Sanders plan would raise tax rates on companies where the.

Their federal taxes came to 145840 for an effective federal tax rate of 26. The Vermont school teacher who made Bernie Sanders mittens featured in the most recent viral meme said she had to stop making them after the federal government taxed her too much. Bernie Sanders Reuters - US.

It would apply when the CEO pay is at least 50 times the medi. Bernie Sanderss effective federal tax rate is rather low. If these tax hikes are included in budget reconciliation and passed the result would be a painfully slow economic recovery.

In 2016 and 2017 when Sanders also earned significant income from his books his effective tax rate was 35 percent and 30 percent respectively. Specifically this plan would impose tax rate increases on companies with CEO to median worker ratios above 50 to 1. In addition to closing loopholes for the wealthy he said that he would also.

Bernie Sanders on Thursday proposed two new bills to hike taxes on corporations and the wealthiest Americans. Sanders plan would also hike the capital gains tax on the upper income brackets. Presidential candidate Bernie Sanders on Monday laid out a plan to hike taxes on big companies with wide pay gaps between executives and rank-and-file workers.

Some key details from Sanders tax returns include. The Vermont teacher who was making mittens part-time including the now-viral Bernie Sanders mittens stopped making them because she was getting taxed too highly.

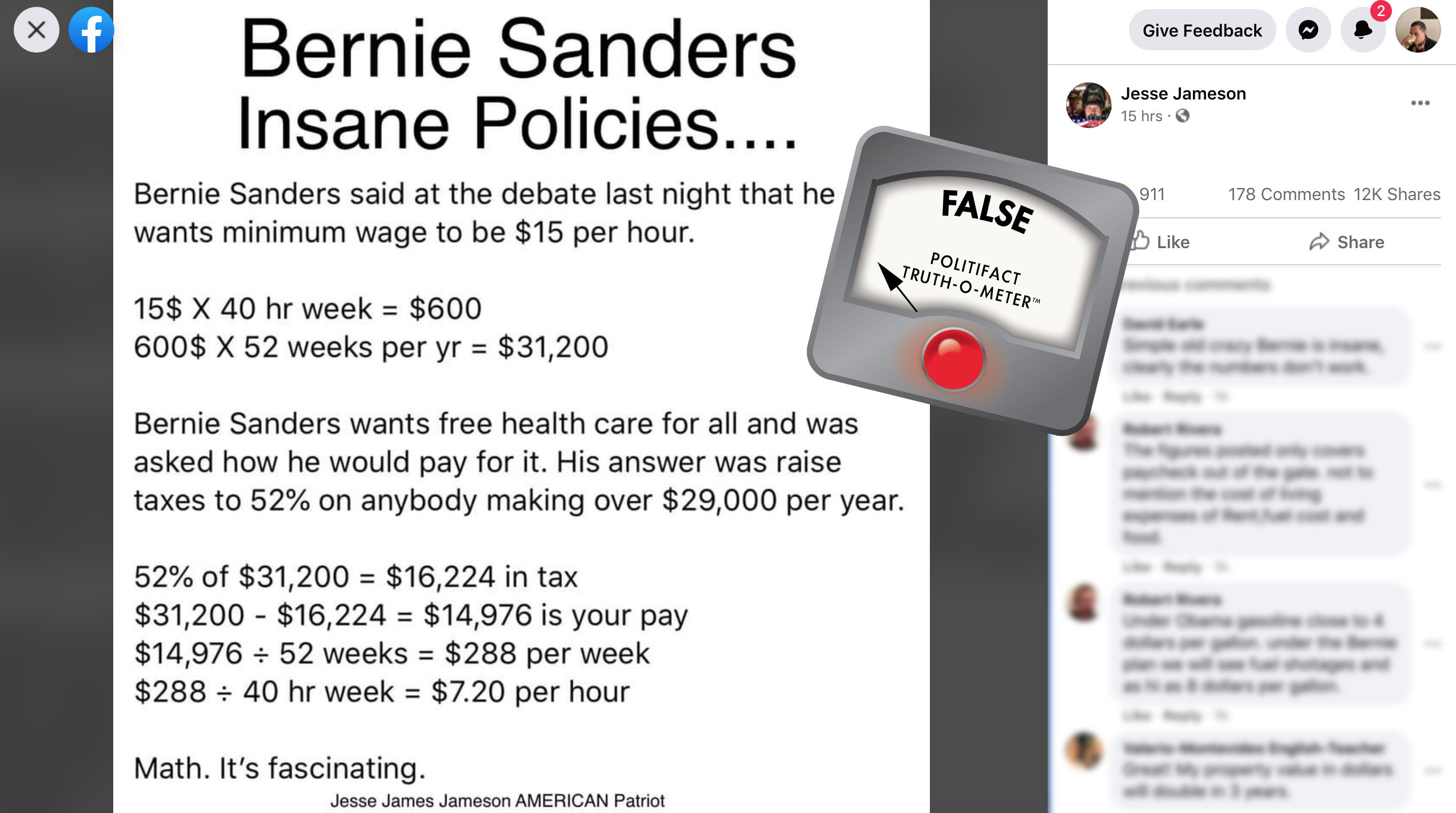

Politifact Viral Post Criticizes Bernie Sanders Math On Health Care Taxes It S Wrong

Politifact Viral Post Criticizes Bernie Sanders Math On Health Care Taxes It S Wrong

The Mammoth Cost Of Bernie Sanders Big Plans

Bernie Sanders Says He Would Raise Taxes On The Middle Class Observer

Bernie Sanders Says He Would Raise Taxes On The Middle Class Observer

Difference In Sanders Warren And Bloomberg S Taxes On The Wealthy

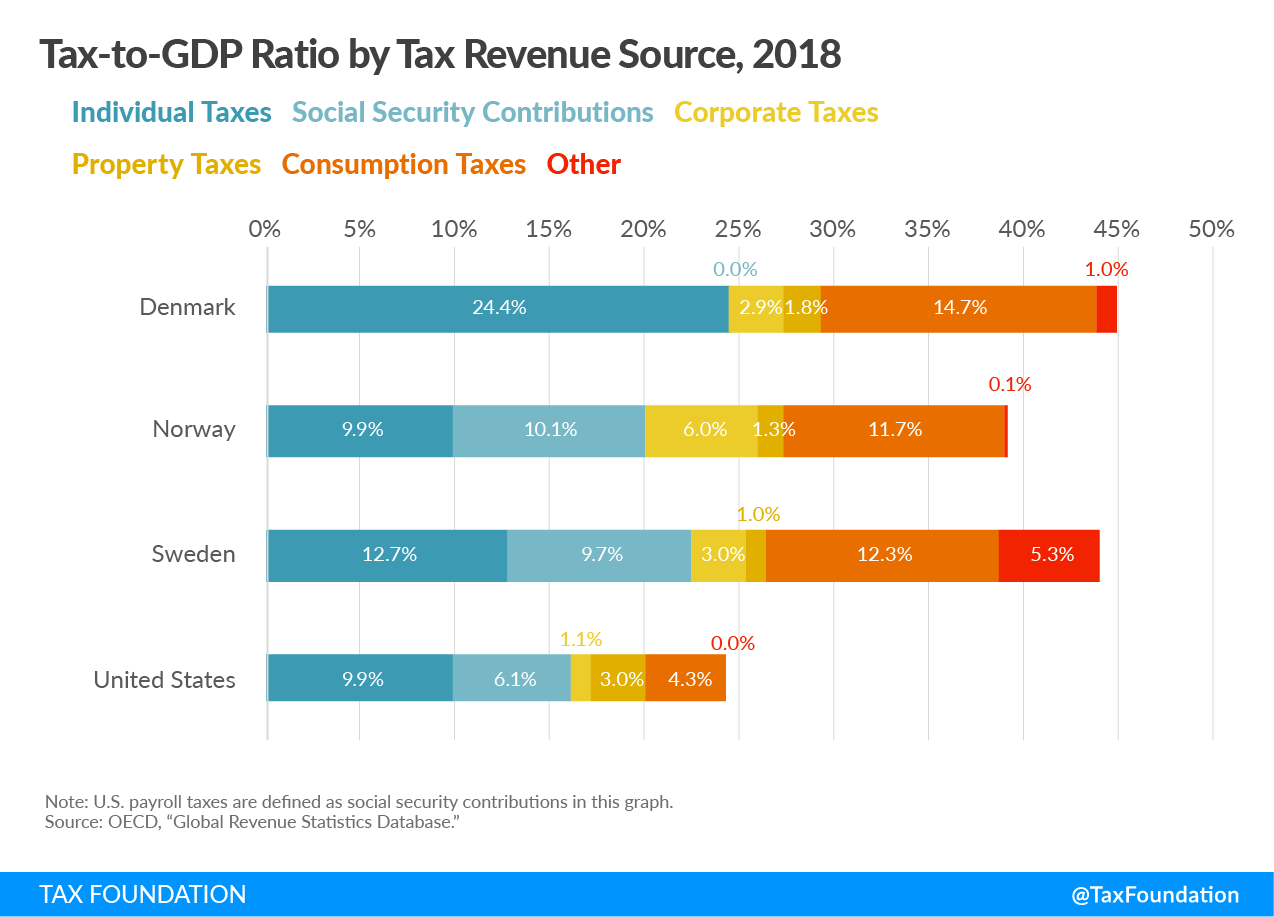

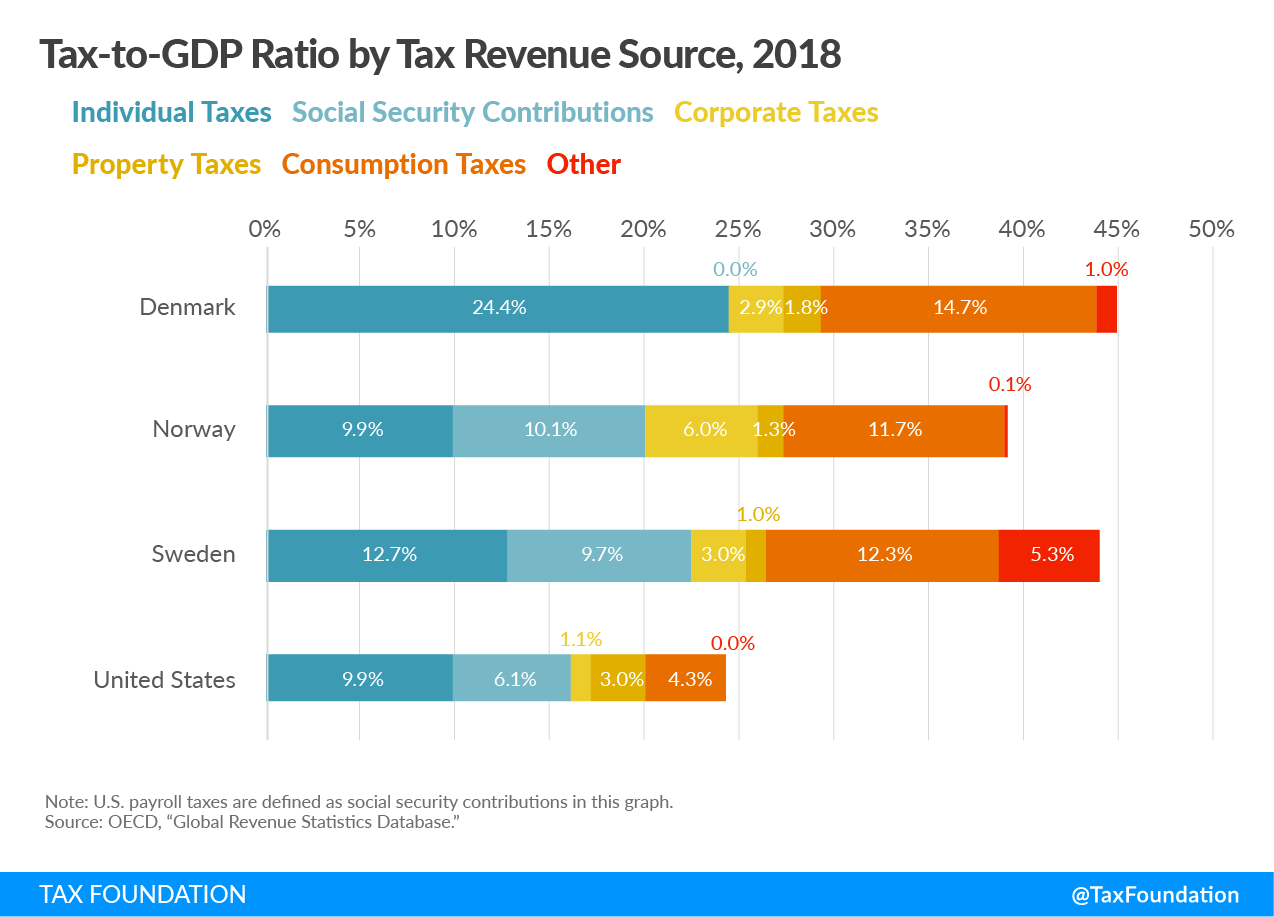

How Scandinavian Countries Pay For Their Government Spending

How Scandinavian Countries Pay For Their Government Spending

Sanders Warren Want To Raise Taxes To Rein In Excessive Ceo Pay Bnn Bloomberg

Bernie Sanders Taxes Here S How Much He D Raise Them Time

Bernie Sanders Taxes Here S How Much He D Raise Them Time

Bernie Sanders Mega Tax Increases Largest In Peacetime History

Bernie Sanders Mega Tax Increases Largest In Peacetime History

Bernie Sanders Wants To Increase Taxes On Companies That Pay Ceos Far More Than Workers Median Salaries Los Angeles Times

Bernie Sanders Wants To Increase Taxes On Companies That Pay Ceos Far More Than Workers Median Salaries Los Angeles Times

Bernie Sanders S Plan Would Raise Taxes By 34 Analysis Finds Wsj

Bernie Sanders S Plan Would Raise Taxes By 34 Analysis Finds Wsj

/cdn.vox-cdn.com/uploads/chorus_asset/file/5925471/sanders-taxes5002.jpg) Here S What The Tax Code Would Look Like If Bernie Sanders Got Everything He Wanted Vox

Here S What The Tax Code Would Look Like If Bernie Sanders Got Everything He Wanted Vox

The Sanders Tax Plan Would Make The U S Tax Rate On Capital Gains The Highest In The Developed World Tax Foundation

The Sanders Tax Plan Would Make The U S Tax Rate On Capital Gains The Highest In The Developed World Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_image/image/62973907/1126201872.jpg.0.jpg) Bernie Sanders Estate Tax Increase For The 99 8 Percent Act Explained Vox

Bernie Sanders Estate Tax Increase For The 99 8 Percent Act Explained Vox

Comments

Post a Comment